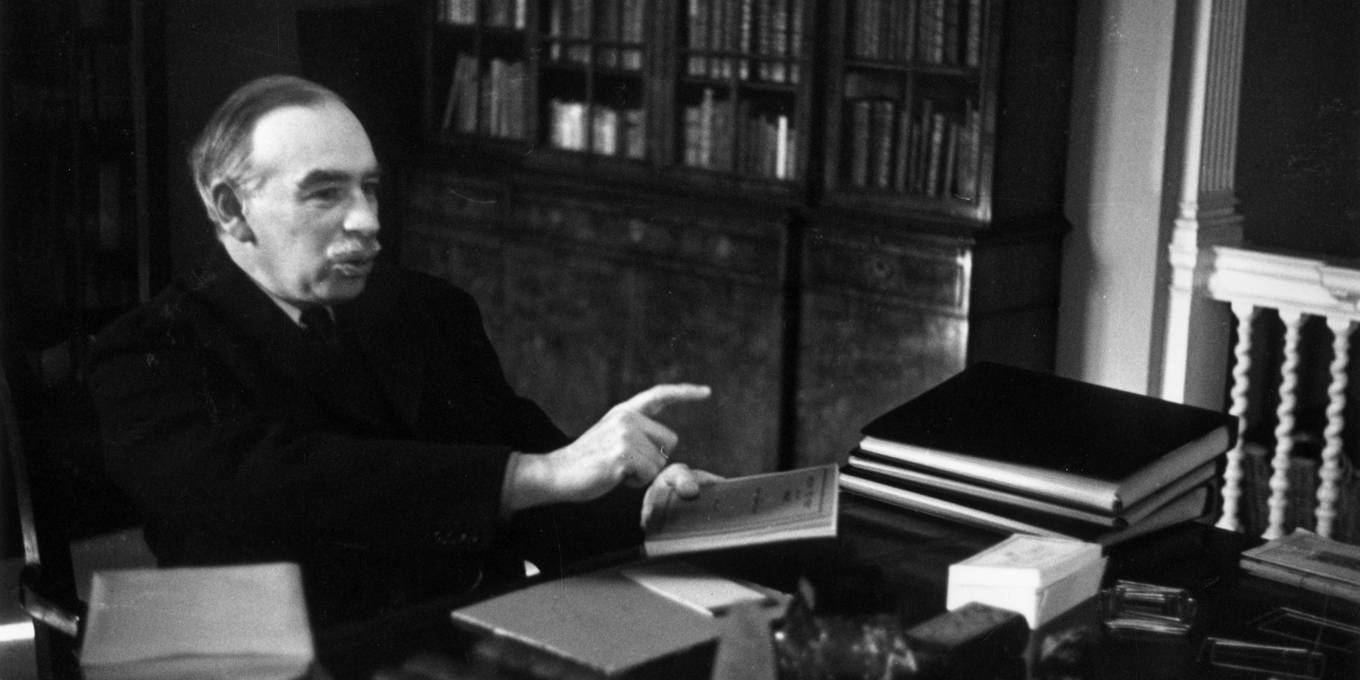

Lance Taylor responds to William Janeway’s essay on John Maynard Keynes and Frank Ramsey. Janeway then offers his response.

William Janeway’s “The Master and the Prodigy” rightly brings the sad short intellectual saga of Maynard Keynes and Frank Ramsey back into prominence. But more than exemplifying Cambridge University’s uninhibited style of argumentation, their interactions and repercussions thereof reflect the quirky originality of the place. Ideas from both had unanticipated but profound consequences that Janeway does not report. Two areas of investigation can be briefly considered here – the interpretation of probability and the implications of economic growth.

Probability

In the paper Janeway describes, Ramsey at age nineteen criticized Keynes’s Treatise on Probability (or TP) which aimed to establish logical relations among probabilistic statements about propositions and evidence (for or against) based on observed “events.” Beyond statements of probability, the events’ “weight of evidence” can affect the acceptability of a proposition.

Consider a large but finite set of possible future events. Ramsey sidestepped Keynes by asserting that a person will decide upon utility-maximizing actions over this set, subjectively assigning a probability to each event. He further assumed that the probabilities add up to one. That is, the individual postulates a complete probability distribution over all happenings that the future may bring. She then solves the problem of maximizing the mathematical expectation of utility in consistent fashion. This exercise, subsequently proposed by Bruno de Finetti and Jimmie Savage, is a statement of the expected utility theory which underpins today’s decision analysis. The model does not fit the data, but still is the benchmark for contemporary behavioral economics.

Keynes responded with restrained praise for Ramsey’s formulation, saying that “the calculus of probabilities belongs to formal logic” but then continued to do something else. Consistently from the TP (mostly written by 1913 but finally published in 1921) through the 1936 General Theory (or GT) and later expository pieces, he argued that while probabilistic propositions may sometimes be comparable, there remain events to which numerical odds cannot be assigned. There may also be events which are simply not within a contemporary observer’s ken. Examples around 1980 included the ozone hole and HIV/AIDS. Although it was recognized in some circles that future pandemics were likely, no one in 2019 had an inkling of the impacts of COVID-19.

With ranking of risks out of the question, the person making the decision must fall back on other devices. She may consider taking a walk in the Fens but wonders whether to bring an umbrella. “If the barometer is high but the clouds are black…it will be rational to allow caprice to determine us and waste no time on the debate.”[1] In the GT, caprice became the famous animal spirits of Chapter 12, in which Keynes criticizes probability-based attempts at investment decision-making.

The originality of this debate resonated well beyond the walls of King’s College. Ramsey’s influence on behavioral economics has already been noted. Keynes is more contemporary. In the TP, the weight of new evidence is a means to strengthen or weaken a hypothesis – more evidence could cut either way. He probably would have disliked the mathematics, but the use of weighting matrices for observations from many sources in artificial neural networks for machine learning goes in the same direction.

Optimal growth

Nowadays, Ramsey’s 1928 paper on “A Mathematical Theory of Saving” is seen as the launch pad for the theory of optimal economic growth. In fact, the Cold War has the stronger claim. In the late 1950s air forces on both sides of the Iron Curtain developed a strong interest in optimizing flight paths of fighter aircraft.[2] Teams of mathematicians around the RAND Corporation in Santa Monica CA and the Steklov Institute in Moscow took on the task. The latter worked out a reformulation of the classical calculus of variations called optimal control theory based on a distinction between state and control variables (see below). Initial publication in Russian in 1961 (English in 1962) by Lev Pontryagin and others put the new mathematics into the public domain.

Given their fascination with shiny mathematical toys, economists rapidly took up control theory.[3] In 1965, more or less independent papers by David Cass and Tjalling Koopmans introduced optimal economic growth. A publication waterfall followed. Only later was Ramsey’s forty-year-old model brought fully into the picture.

A comment on Janeway is not the place to review optimal growth. But two points stand out, illustrating how even Ramsey and Keynes combined could be wrong.

The growth models involve ordinary differential equations for changes over time of two “state variables” – the capital stock and its asset price (analogs in the traditional calculus of variations are the position of a particle subject to a force, and its momentum). The Pontryagin formulation also includes “control variables” such as consumption (or saving = output minus consumption) which influence the dynamics of the states.

Optimal growth is interpreted as meaning that ”society” or an immortal “representative agent” maximizes the discounted utility of consumption over a perfectly foreseen infinite time horizon. The mathematics says that there is only one time path of capital and its asset price that will solve this problem. Its trajectory will converge to a state of steady growth in which new capital formation equals the sum of depreciation per unit of capital and the growth rates of labor productivity and population.

Along all other paths capital will diverge toward zero or infinity. For an initially given capital stock the asset price (or the level of consumption) has to be specified exactly to get the economy on the optimal path. The fact that selecting a single number from a continuum is beyond mere human agency is not widely discussed, even though the models are being used to analyze contemporary issues such as climate change.

An exogenous positive “pure” rate of discount enters standard calculations. One justification is that future generations may be richer than we are; another is that people consistently undervalue future in comparison to present consumption. More practically, a solution to the model will not exist unless the pure discount rate exceeds the labor force growth rate.

As Janeway observes, Ramsey rejected a pure discount rate. To get his model to converge, he came up with an alternative – at some level of consumption its utility saturates with marginal utility falling to zero. He called this situation Bliss. At Bliss with constant consumption, no depreciation and zero productivity and population growth, the profit rate would be zero.

Dynamics of Bliss

Shortly after Ramsey’s untimely death, Keynes published an article called “Economic Possibilities for Our Grandchildren” in the Yale Review. The gist is that capital accumulation and labor productivity growth will boost output per capita over generations, allowing less work and much more leisure for the masses. In the GT a few years later, he foresaw the euthanasia of the rentier due to a falling rate of profit. Textual evidence is scant, but both projections are consistent with an economy at Bliss. Abstracting from climate change (if that makes any sense), what sort of path should the economy follow to get there?[4]

On the production side, the profit share and the capital/output and capital/labor ratios should gradually run down. Since about 1980 in the USA, the opposite has been the case. The economy is running Ramsey dynamics in reverse.[5] It is also becoming more dualistic. The employment share in sectors of production with low wages and productivity has increased by almost twenty percentage points over two decades.

Greater leisure at Bliss is equivalent to high unemployment in contemporary usage – fewer employed workers or a drastic reduction in the length of the working day. Luigi Pasinetti pointed out that at the macro and sector levels, the unemployed share of the (working age) population will go up if the rate of productivity growth exceeds growth of output per capita. But demand for goods and services may continue to rise steadily if modern capitalism continues to produce an unending stream of novel products to be consumed. As in Thorstein Veblen’s Theory of the Leisure Class, conspicuous consumption and status emulation become the driving forces behind economic expansion. How demand vs. productivity growth will play out in the future remains to be seen.

To generate income and demand at low Bliss employment, the real wage would have to increase. Over time, that can only happen if wage growth exceeds productivity growth. The rising profit share noted above means that in the USA the opposite has been happening for fifty years. The euthanasia of the rentier could transfer income to the lower classes, but probably not enough to support high payments to leisurely households. Something like a tax- or debt-based universal basic income scheme might have to be implemented.

Finally, because of the intrinsic dynamics of the capital/labor ratio a properly Keynesian demand-led growth model would arrive at a steady state close to the one emerging from a supply-driven Ramsey formulation. A favorable demand shock would lead to a lower profit share and higher employment along the way.

Bliss is an appealing concept. How to get there is a dynamic problem that neither Keynes nor Ramsay addressed in practical modeling terms.

[1] Applying expected utility without an explicit probability distribution, with black clouds in Cambridge I would certainly carry an umbrella. The natives are more robust.

[2] Example: a supersonic fighter must first pick up speed in a dive in order to climb to a given altitude in minimum time.

[3] Other examples include using linear and non-linear programming models for planning in developing economies, and applying the “physics math” of Brownian motion to pricing of financial derivatives. The planning models have long since vanished. Like subjective utility, simple derivative pricing models don’t fit the data but still serve as an intellectual benchmark.

[4] Mitigating greenhouse gas emission adds dynamic complications. As with the diving fighter plane in footnote 2, mitigation effort should be front-loaded, perhaps as much as several percent of world GDP.

[5] The same is true of the Solow-Swan growth model which replaces Ramsey’s fancy optimization of saving over time with a simple constant saving rate.

Response to Lance Taylor

William Janeway

I am grateful to Lance Taylor for this characteristically insightful set of comments. Professor Taylor penetrates further than I did into a realm where he and Keynes and I all agree: there are possible outcomes not only for which any assigned probability is necessarily arbitrary (as Keynes put it in 1937, “we just don’t know”) but there are outcomes of which we are simply not aware as even possible. Another way to put it is that Ramsey’s probabilities do not sum to 1: they do not exhaust the space of possible outcomes. On the other hand, my emphasis was especially on Ramsey’s introduction of pragmatism, the evaluation of subjective assessment of probabilities by observing actions. I hope that Lance agrees that this was a lasting contribution.

I do defer entirely to Lance on the subject of optimum growth theory. I recall discussion of the lineage he summarizes in Philip Mirowski’s Machine Dreams. I was struck as Lance notes, by Ramsey’s rejection of a “pure” social rate of discount, as I was by his recognition that the marginal utilities of money for an individual is an inverse function of income and wealth. Ramsey refused to value the living generation over future ones. But there is another issue, as well. Specifying a “social rate of discount” for a society whose income and wealth are as unequally distributed as that of the US today – or that of the UK in the 1920s - is an ethical abomination.

In any case, I am pleased to have provoked this extension of my essay.