In new research, Donald Tomaskovic-Devey writes that the concentration of wealth and power in the financial service industry has led to lower living standards and weaker state investment in citizens and infrastructure. He argues that tax and fiscal policies should promote investment in production and employment over financial strategies by non-finance firms.

Since 1980 there has been a vast expansion of the economic power and centrality of financial service sector. Less well known is the simultaneous shift in the investment strategies of non-financial firms, at least in the US,

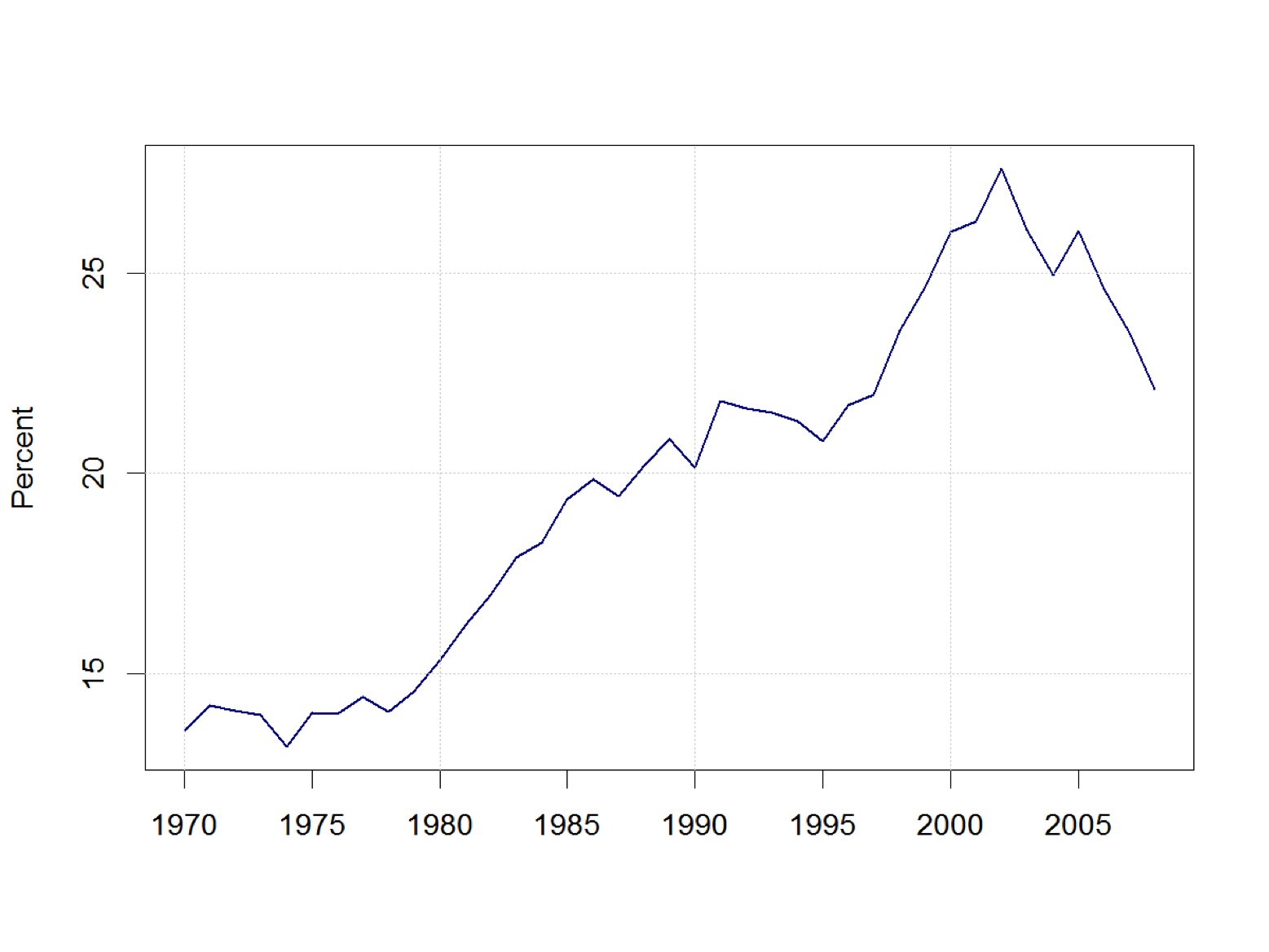

toward investing in financial instruments of various sorts. As Figure 1 shows, by the early 2000s financial investments had risen to almost 30 percent of total assets in the U.S. private sector. In our on-going research we have tried to figure out if this shift in corporate investment strategies has been economically destructive. Our answer is that it has and that economic growth and U.S. standards of living have suffered as a result.

Figure 1 - Financial Assets as a Percent of Total Assets, US Non-Financial Sectors 1970-2008

We already know that the concentration of wealth and power in the financial service industry has introduced fragility into the world economy, reduced both fixed investment and R&D, and increased inequality in the advanced economies. Instability, sector shifts and inequality are not, however, evidence that financialization has been harmful to general economic growth. In a capitalist system shocks, sectoral shifts and cyclic destruction, even rising inequality are not inconsistent with long run growth in standards of living.

It is possible that financial investment strategies, despite increasing inequality, lifted all boats. If this is what happened then the policy case against financialization is weakened considerably. On the other hand, if financialization of the non-finance sector is associated with decreased total production then contemporary movements toward a financialized non-finance sector are economically as well as socially destructive.

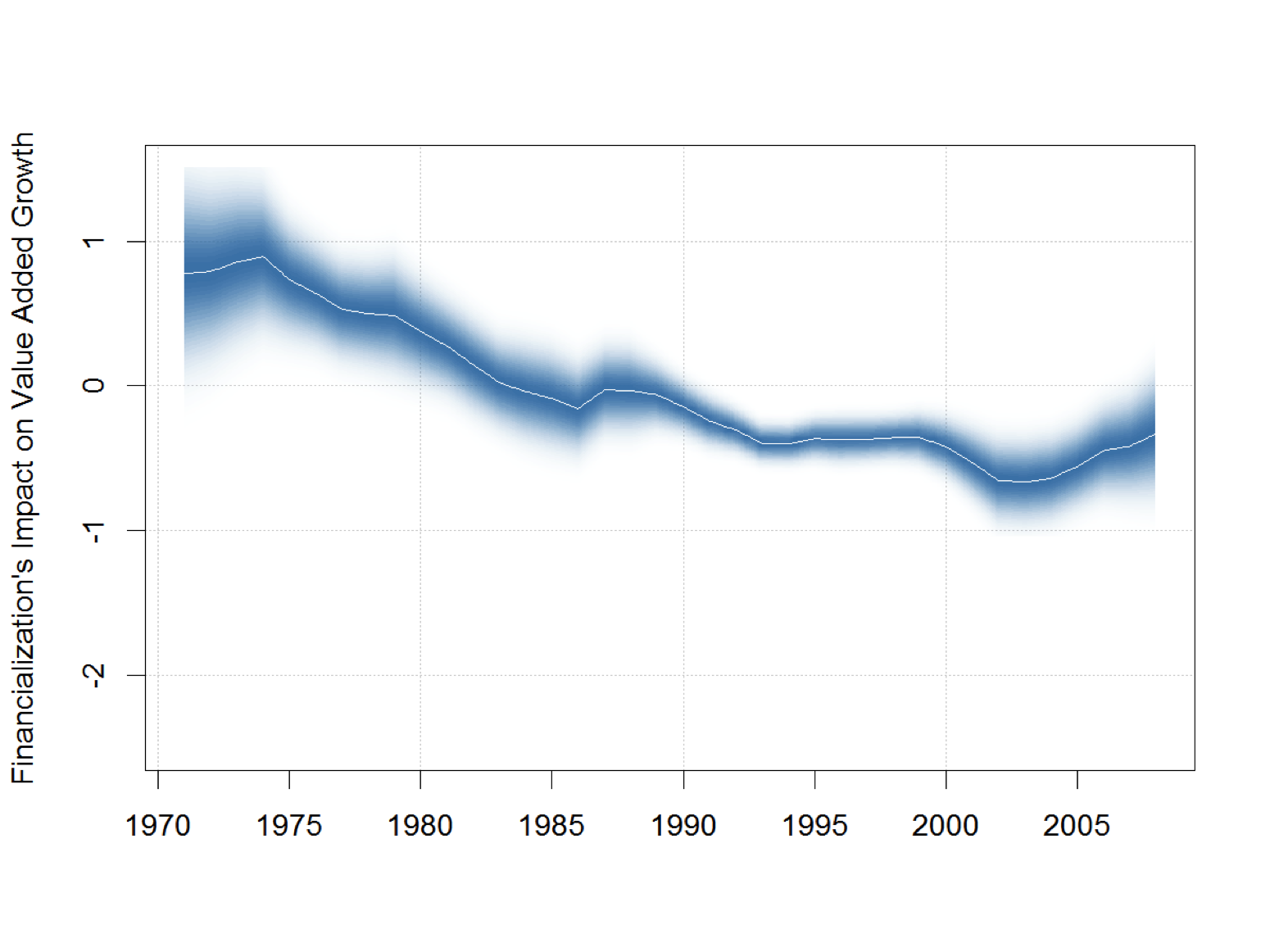

Prior to 1980 firms like GE and GM used debt financing of their products to support growth in market share. During this period we find that financial investments by non-finance firms were much lower (Figure 1) and encouraged economic growth. This can be seen in the positive effect of financial investments on growth in value added prior to 1980 in Figure 2.

Figure 2 - The Impact of Financial Investment on Non-Financial Sector Value-Added

After 1980 many non-financial firms moved in more speculative directions, into stock, credit, currency and even derivative markets. After 1980 we find that financial investment strategies by non-financial corporations are associated with

reductions in value added, as Figure 2 shows. We estimate that since 1980 financial investments on Main Street stripped the US economy of at least 3.9 percent of aggregate growth, or about three years of lost growth in GNP. For comparison sakes, the great recession of 2008 produced aggregate negative growth of 2.9 percent.

One might wonder if more value could have been produced if more money had been invested in production. For some this may be somewhat difficult to imagine in an era of increased global competition.

Our research shows that while financialization reduced economic growth, both computer investment and hiring more skilled labor forces were associated with growth in productivity. Global competition was actually economically neutral. Together these results strongly suggest that firms that invested in production technologies saw rising value added, even in the face of global competition.

Not surprisingly the losers from this financialization trend were the citizens of the US. These losses occurred through four channels — lower employment, reduced wages among the employed, lower capital investment in new production, and lower tax revenues at the local, state, and federal level.

Even as growth declined, payments to capital increased. This happened in two ways – the substitutions of debt for equity in large corporate investment strategies and using profits to buy back stock rather than to invest in future production. Both practices reduce the shares of stock outstanding and correspondingly raise the return on equity, perversely by reducing equity rather than by raising production and profits, and as a result prop up stock prices. During this same period, stock prices have become the primary vehicle for top executive compensation. Thus we see two winners from the financialization of Main Street- corporate executives and Wall Street.

Since this has happened during a period of rapid increases in income inequality, it is safe to say that for the vast majority of the US population financialization has led to lower standards of living as well as weaker state investment in both citizens and infrastructure than what would have been possible under a more production-focused regime.

Our results reinforce the findings in recent research that finds that increased financialization in developed economies can harm economic growth. Since the pursuit of financial investment strategies by non-financial firms leads to lower growth it appears to be an irrational investment strategy. But this conclusion is only true if looked at from a macroeconomic perspective. From the viewpoint of the firm with multiple stakeholders, financialization has benefited capital at the expense of labor and the state.

The shareholder value movement encouraged firms to replace equity with debt and to reduce employment. Reductions in employment were taken as signals of managerial seriousness and rewarded with surges in stock prices. The shareholder value movement also produced a perverse set of incentives to reduce total production and probably in the long run even total profit, while boosting stock prices and dividend payments on the remaining equity.

We think it is now imperative that tax and fiscal policies should distinguish between fixed and financial investment, and should target incentives toward investment in production and employment over financial strategies by non-finance firms. The current practice of low marginal tax rates on capital gains probably encourages financial speculation over production investment, and as a result growing income shares to capital and declining employment and tax revenue.

Since prior literature has made clear that both the increased rent taking by the financial services firms and financial behavior on “main-street” have exacerbated both instability and inequality, it seems plausible to conclude that the latest phase of capitalism – financialization – is both socially and economically problematic. Workers and the society (via state capacity) have been harmed, shareholders have benefited, and income streams to debt-based securities have increased.

A smaller, less equal, more unstable, but more Wall-Street friendly economy has been the result.

Note: This article was first posted on USApp – American Politics and Policy, London School of Economics and is based on the paper ‘Did financialization reduce economic growth?’ in the Socio-Economic Review.

About the author

Institute for New Economic Thinking Grantee Donald Tomaskovic-Devey is Professor of Sociology at the University of Massachusetts, Amherst. His research on financialization with Ken-Hou Lin and Nathan Meyers has been published in the American Sociological Review, the American Journal of Sociology, the Socio-Economic Review and the North Carolina Banking Institute Journal. The U.S. National Science Foundation and the Institute for New Economic Thinking supported this research. His first book in 1983, with S.M. Miller, was Recapitalizing America: Alternatives to the Corporate Distortion of National Policy (Routledge & Kegan Paul) and his most recent, with Kevin Stainback, is Documenting Desegregation: Racial and Gender Segregation in Private Sector Employment since the Civil Rights Act (2012 Russell Sage).