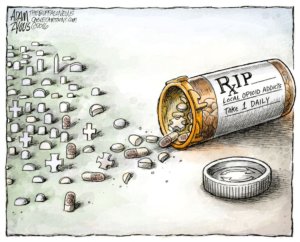

Price gouging in the US pharmaceutical drug industry goes back more than three decades.

In 1985 US Representative Henry Waxman, chair of the House Subcommittee on Health and the Environment, accused the pharmaceutical industry of “gouging the American public” with “outrageous” price increases, driven by “greed on a massive scale.” Even in the wake of the many Congressional inquiries that have taken place since the 1980s, including one inspired by the extortionate prices that Gilead Sciences has placed on its Hepatitis-C drugs Sovaldi since 2013 and Harvoni since 2014, the US government has not seen fit to regulate drug prices. UK Prescription Price Regulation Scheme data for 1996 through 2010 show that, while drug prices in other advanced nations were close to the UK’s regulated prices, those in the United States were between 74 percent and 181 percent higher. Médecins Sans Frontières (MSF) has produced abundant evidence that US drug prices are by far the highest in the world.

The US pharmaceutical industry’s invariable response to demands for price regulation

has been that it will kill innovation. US drug companies claim that they need higher

prices than those that prevail elsewhere so that the extra profits can be used to augment

R&D spending. The result, they contend, is more drug innovation that benefits the United

States, and indeed the whole world. It is a compelling argument, until one looks at how

major US pharmaceutical companies actually use the profits that high drug prices

generate. In the name of “maximizing shareholder value” (MSV), pharmaceutical

companies allocate the profits generated from high drug prices to massive repurchases, or

buybacks, of their own corporate stock for the sole purpose of giving manipulative boosts

to their stock prices. Incentivizing these buybacks is stock-based compensation that

rewards senior executives for stock-price “performance.”

Like no other sector, the pharmaceutical industry puts a spotlight on how the political economy of science is a matter of life and death. In this paper, we invoke “the theory of innovative enterprise” to explain how and why high drug prices restrict access to medicines and undermine medical innovation. An innovative enterprise seeks to develop a high-quality product that it can sell to the largest possible market at the most affordable price. In sharp contrast, the MSV-obsessed companies that dominate the US drug industry have become monopolies that restrict output and raise price. These companies need to be regulated.