This post gives a quick introduction to the main monetary challenges faced by the PBoC. Next time I’ll connect the property bubble to the central bank.

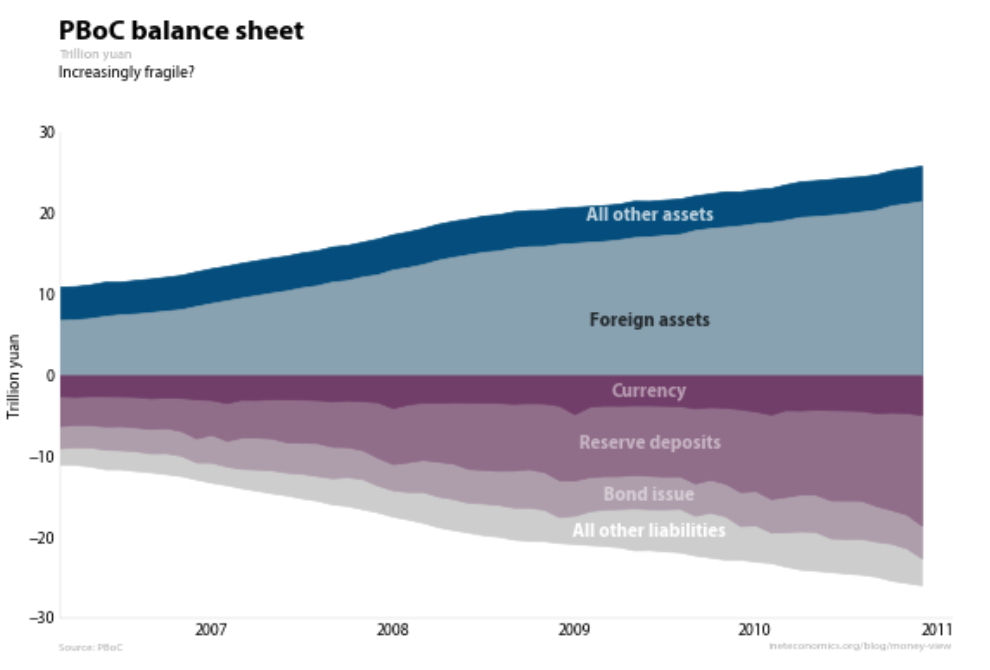

The graph shows the PBoC balance sheet from 2006 through the end of 2010, in my preferred representation (see this post and this post for the Fed’s balance sheet in a comparable format). Assets are shown as positive numbers, liabilities as negative numbers.

The organizing principle of the PBoC balance sheet is the secular expansion in foreign assets, which are the quantitative consequence of the country’s exchange-rate policy. The effect is almost mechanical: China pegs the dollar/renminbi exchange rate, and to hold the peg, it must stand ready to buy and sell renminbi at that price. Over the period shown, pressure has always been for renminbi appreciation, so holding the peg means that the PBoC must buy dollars and sell renminbi. (If it did not, renminbi would be in excess demand, dollars in excess supply, and the renminbi would have to appreciate, breaking the currency peg.)

Dollars enter China through its export sector, so the central bank buys them from exporters’ banks by issuing new liabilities, mostly bank reserves.

What happens now? This newly created high-powered money eases commercial banks’ reserve constraint, and if no other action were taken, the banks would be free to expand renminbi lending proportionally. This lending would go to fund new domestic spending, whether on investment or consumer goods.

Such credit expansion would likely lead to domestic inflation, and the Chinese government is quite sensitive to the social consequences of rapid price rises. So the PBoC tries to offset the effect on domestic prices. This used to be done with so-called sterilization bonds (which sought to “sterilize” the inflationary consequences of exchange-rate intervention), which show up in the graph as “Bond issue”. These bonds replace a more money-like liability of the central bank, reserve deposits, with a less money-like liability—a bond that cannot fund credit expansion.

These days sterilization bonds are less used, with the preferred policy tool now being the required reserves themselves. Rather than compelling banks to buy bonds, it simply raises the amount they have to hold in reserve against deposits. Now newly-created renminbi reserves do not immediately translate into new lending, and so domestic price rises are contained.

The system has basically worked, at least in the medium run—China has shown consistently high growth while price rises have been contained.

But this masks an increasingly fragile financial configuration. Internally, repeated reserve increases limit lending by the formal banking system. But while export demand is high, investment demand and thus demand for loans will also remain high. This creates opportunities for the informal banking sector. And these loans add to price pressures anyway, negating the whole intent of the policy.

There are external fragilities too. We see signs that the PBoC is interested in diversifying out of dollars. Yet as long as the US continues to run the trade deficit that is the counterpart of China’s trade surplus, it will mostly continue to accumulate dollar-denominated assets. If the PBoC wants to sell a large amount of dollars for some other currency, it will drive down the dollar exchage rate, quite possibly causing the renminbi to appreciate, again negating the intent of the policy.

The property bubble has the potential to put particular strain on the PBoC balance sheet, as we shall see next time.