Pharmaceutical drugs are often a matter of life or death. It should be a prime objective of government policy to rid the industry of financialization.

Distributions to shareholders

The performance of the U.S. economy depends heavily on the resource-allocation decisions of very large corporations. In 2016, 2,102 companies had 5,000 or more employees in the United States, with an average of almost 21,000 per firm.[1] These enterprises were only about one-third of 1% of all firms in the U.S. economy, but they had 35% of all business-sector employees, 40% of payrolls, and an estimated 46% of revenues.

Many of the largest companies in the United States are highly financialized, distributing almost all, and often more, of their profits to shareholders in the form of stock buybacks and cash dividends. In 2009-2018 the 466 companies in the S&P 500 Index that were publicly listed over the decade expended $4.0 trillion on buybacks, equal to 52% of profits, plus $3.1 trillion on dividends, representing another 40% of profits. Data on the 222 companies in the S&P 500 Index that were publicly listed from 1981 through 2018 show that buybacks as a form of distribution of corporate cash to shareholders became widespread in 1984 and subsequently were done in addition to (not instead of) dividends, with the dollar value of buybacks first surpassing that of dividends in 1997. In 1981-1983, these 222 companies spent 5% of profits on buybacks and 50% on dividends; in 2016-2018, the same companies paid out 64% as buybacks and 52% as dividends.

In their book, Predatory Value Extraction, based on research funded by the Institute for New Economic Thinking, William Lazonick and Jang-Sup Shin call the increase in stock buybacks since the early 1980s “the legalized looting of the U.S. business corporation,” while in a forthcoming paper, Lazonick and Ken Jacobson identify Securities and Exchange Commission Rule 10b-18, adopted by the regulatory agency in 1982 with little public scrutiny, as a “license to loot.”[2] A growing body of research, much of it focusing on particular industries and companies, supports the argument that the financialization of the U.S. business corporation, reflected in massive distributions to shareholders, bears prime responsibility for extreme concentration of income among the richest U.S. households, the erosion of middle-class employment opportunities in the United States, and the loss of U.S. competitiveness in the global economy.[3]

Perhaps no business activity is more important to our well-being than the discovery, development, and distribution of medicines. Unfortunately, many of the largest U.S. pharmaceutical companies have become global leaders in financialization at the expense of innovation. Drug prices are at least twice as high in the United States as elsewhere in the world.

Over the decades, pharmaceutical companies have lobbied vigorously against proposed market regulations designed to control drug prices in the United States. The main argument that the industry’s lobby group, the Pharmaceutical Research and Manufacturers of America (PhRMA), habitually makes against drug-price regulation is that the high level of profits that high drug prices make possible in the U.S. drug market enables pharmaceutical companies to be more effective in drug innovation. A New York Times article published in 1985 reported that, in response to accusations against pharmaceutical companies by then-U.S. Rep. Henry Waxman (D-CA) of “outrageous price increases” and “greed on a massive scale,” drug-company executives asserted that “prices have climbed recently to cover accelerated investment in researching and developing new and better medications to protect Americans.”[4] In a recent publication, PhRMA defends the profits of its corporate members by stressing the high cost of drug development: “From drug discovery through FDA [Food and Drug Administration] approval, developing a new medicine takes, on average, 10 to 15 years and costs $2.6 billion. Less than 12% of the candidate medicines that make it into Phase I clinical trials are approved by the FDA.”[5]

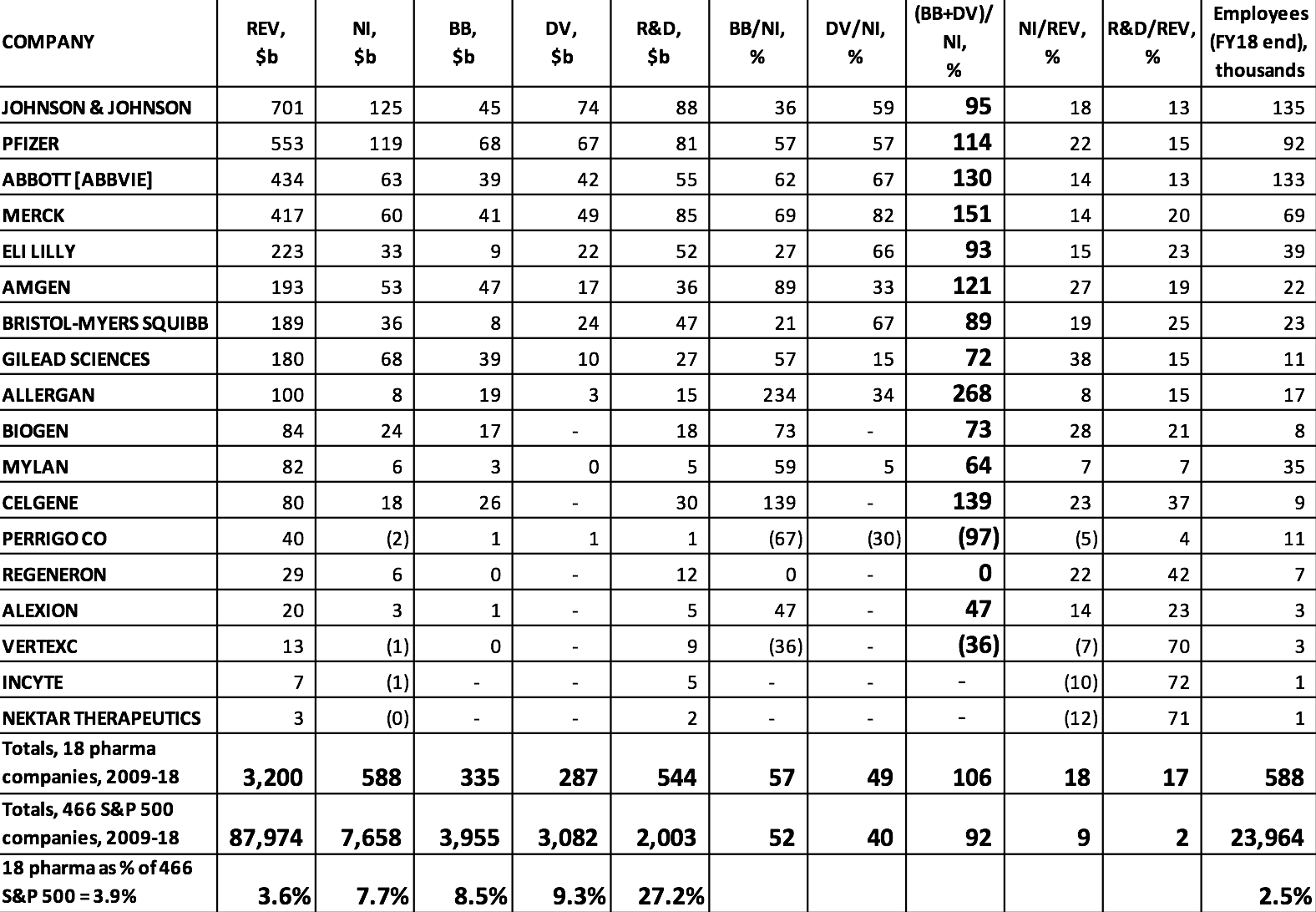

Drug research and development is a very expensive and highly uncertain endeavor, and established pharmaceutical companies must reinvest profits to finance this innovation process. Yet, as can be seen in Table 1, many of the largest pharmaceutical companies in the United States use all of their profits, and in some cases far more of their financial resources than that, to distribute cash to shareholders. As it turns out, U.S. households pay high drug prices so that, by allocating corporate cash to buybacks and dividends, pharmaceutical executives can use the high profits to drive up stock prices. As shown in Table 1, there were 18 pharmaceutical companies among the 466 S&P 500 companies that were publicly listed from 2009 to 2018. With combined profits of $588 billion from 2009 through 2018, these 18 companies spent $335 billion on buybacks and $287 billion on dividends over that decade.

These distributions to shareholders were 14% greater than the $544 billion that these companies devoted to R&D spending. The 18 pharmaceutical companies comprised 3.9% of the 466 companies from all industrial sectors, but they distributed 8.5% of all buybacks and 9.3% of all dividends. Buybacks and dividends amounted to 106% of the 18 companies’ combined profits, compared with 92% for all 466 companies in the 2009-2018 sample. Big pharmaceutical companies are big on doing distributions to shareholders.

Table 1 also shows that the 466 companies spent 2% of total revenues on activities reported as R&D, while this proportion for the pharmaceutical companies was 17%. Pharmaceuticals is one of the most R&D-intensive industries, and in U.S. industry more generally R&D spending is concentrated among a relatively small number of firms. In 2018, among the 500 companies in the S&P 500 Index, just 38 companies, including 14 in pharmaceuticals, accounted for 75% of all R&D spending.

Table 1. Stock buybacks, cash dividends, and R&D expenditures, 2009-2018, at the 18 U.S. pharmaceutical companies in the S&P 500 Index in January 2019 Notes: REV=revenues; NI=net income; BB=stock buybacks; DV=cash dividends; R&D=research and development expenditures ABBOTT [ABBVIE] includes the combined financial figures of Abbott Laboratories and the company’s pharmaceutical subsidiary, AbbVie, from 2013 to 2018. Source: S&P Compustat database; updated from Lazonick et al., “U.S. Pharma’s Financialized Business Model”; and Tulum and Lazonick, “Financialized Corporations in a National Innovation System.”

But just because a company spends billions of dollars on R&D does not mean that this spending is productive. Öner Tulum’s in-depth analyses of specific pharmaceutical companies show that those corporations that are the most financialized in terms of distributions to shareholders are those whose spending on R&D is least productive per dollar spent.[6] Among these companies are Merck and Pfizer, whose R&D expenditures ranked them #9 and #10 in that department among all U.S. companies in 2018. These companies have grown large by acquiring “blockbuster” drugs that other companies have developed and then milking them for revenues over their remaining patent lives.[7] Meanwhile, notwithstanding all of their R&D spending, these companies do little in the way of internal drug development.

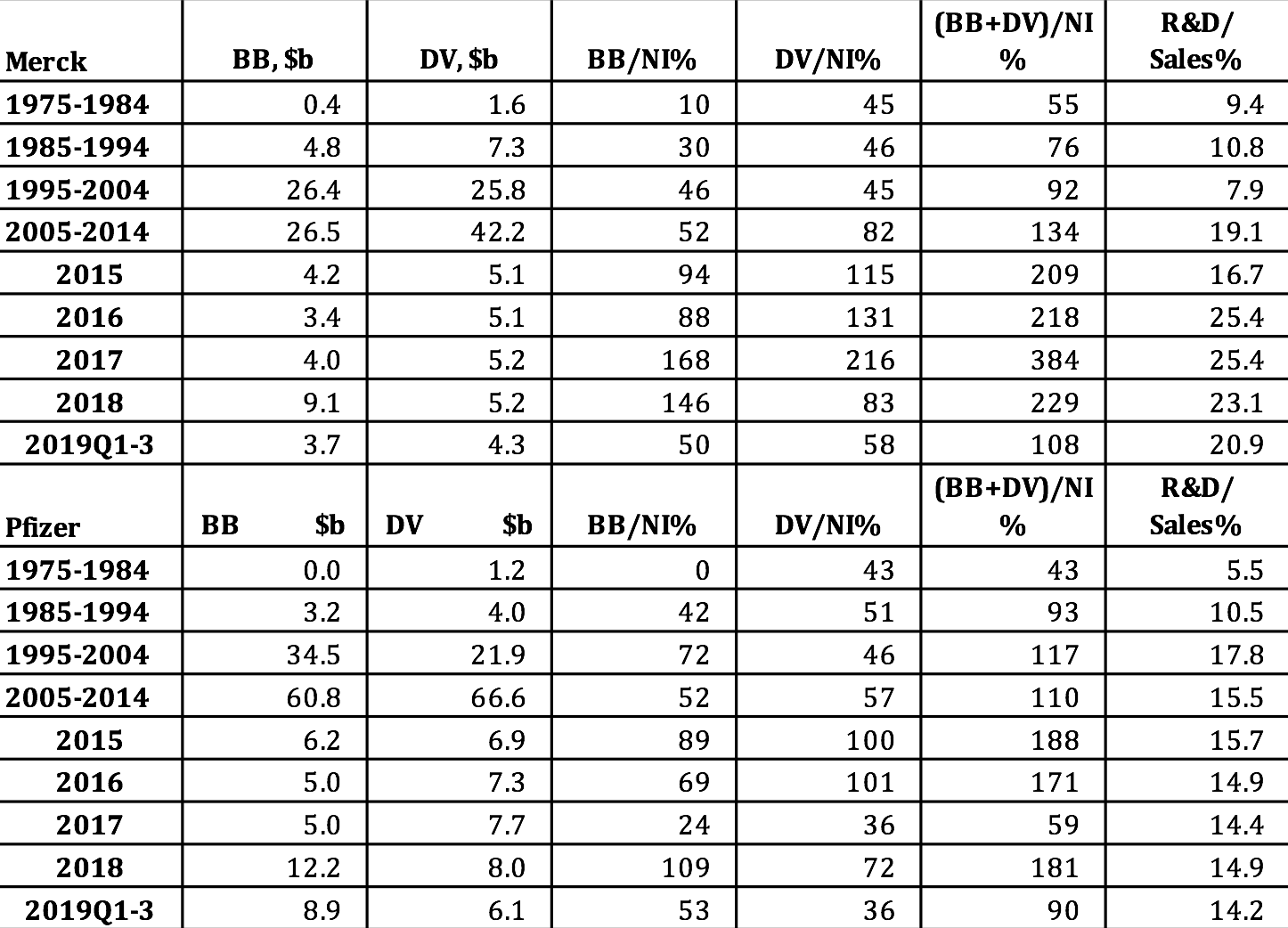

Merck and Pfizer are among the companies in Table 1 that distributed well in excess of 100% of their profits to shareholders in 2009-2018. As Table 2 shows, massive distributions to shareholders are nothing new at Merck and Pfizer. In addition to paying ample dividends, which accrue to all shareholders, since the mid-1980s both companies have been increasingly aggres-sive at buying back their own shares on the open market, thus creating opportunities for sharesellers to gain through the timing of the sale of shares in these companies. Among those parties best positioned to reap the gains from these trades are hedge-fund managers, Wall Street bankers, and the senior executives of the companies that are doing the buybacks.[8]

Note that buybacks to net income (BB/NI) and dividends to net income (DV/NI) are sensitive to changes in the denominator of these payout ratios. In 2017 buybacks and dividends absorbed “only” 59% of Pfizer’s net income. By comparison, in 2016 Pfizer’s buybacks and dividends had represented 171% of net income. Yet in 2017 the dollar value of Pfizer’s buybacks was the same as it had been in 2016, while that of its dividends was somewhat higher. In 2017, however, the company’s profits were $21.3 billion, almost triple the $7.2 billion that it booked in 2016. Behind Pfizer’s super-profits in 2017 were adjustments that the company made in its provision for corporate taxes as a result of the Tax Cuts and Jobs Act of 2017, which lowered the corporate tax rate on profits from 35% to 21%.

Two years earlier, in October 2017, in a Wall Street Journal interview, Pfizer CEO Ian C. Read had complained that the company’s U.S. tax bill put it at a “tremendous disadvantage” in global competition. “We’re fighting,” Read said, “with one hand tied behind our back.”[9] For that reason, Pfizer was planning a merger with Allergan, a company that had formerly had its tax base in the United States but had done a corporate inversion, shifting its headquarters to Ireland to obtain the benefit of the far lower corporate income-tax rate that prevailed there. Research that we undertook in response to Read’s claim shows that during Read’s tenure as Pfizer CEO, which began in 2011, the company did buybacks that were triple the amount that the company provisioned for U.S. federal taxes, and that dividend payments were double this tax bill.[10]

It was therefore disingenuous for CEO Read to argue that the high U.S. corporate tax rate placed Pfizer at a disadvantage in global competition. The company would have needed only to rein in its distributions to shareholders to obtain the after-tax profits that could have been used to ramp up its investments in innovative drugs. As it turned out, in 2016 the Obama administration prevented the merger with Allergan, leaving Pfizer to pay taxes in the United States.[11] The following year, however, with Trump as president, the Republicans delivered permanently lower tax rates to U.S. corporations, Pfizer of course included.[12]

Table 2. Merck and Pfizer distributions to shareholders as stock buybacks and cash dividends, in billions of current dollars and as percent of net income, 1975-2019 Notes: NI=net income; BB=stock buybacks; DV=cash dividends Sources: S&P Compustat database; Merck and Pfizer SEC 10-K and 10-Q filings.

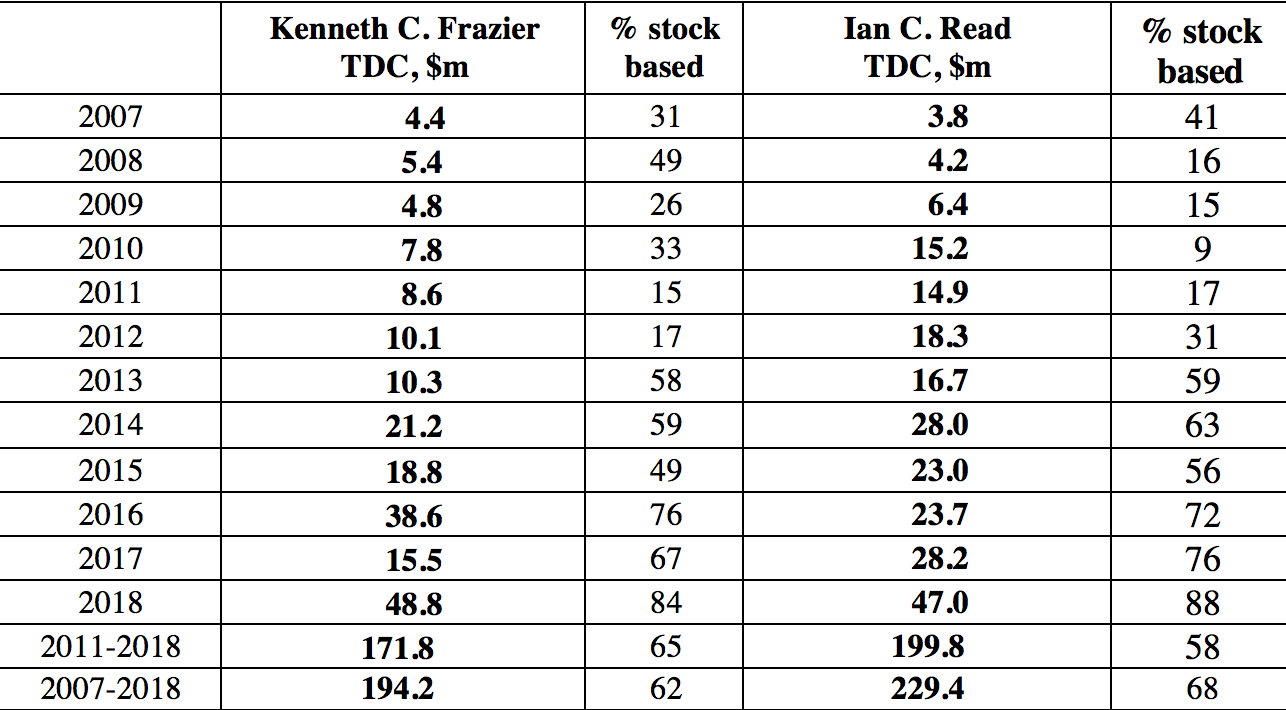

Stock-based executive pay

Why do CEOs like Pfizer’s Read do all these distributions to shareholders? They are incentivized to do so by the ways in which they are paid. Specifically, the stock-based components of their total compensation reward them for increasing in any way possible the stock prices of the companies that they lead. Table 3 shows the total direct compensation and its components for the CEOs of Merck and Pfizer from 2007 through 2018, during the last eight years of which both executives were their companies’ CEOs. As Merck CEO, Kenneth Frazier raked in an average of $21.5 million per year in total compensation, with 65% of it from realized gains from the exercise of stock options and the vesting of stock awards. Not to be outdone, Pfizer CEO Read took home an average of $25.0 million per year, of which 64% came from his stock-based pay. If, as Read argued, Pfizer has problems competing globally, perhaps it is because of the golden handcuffs that he as the company’s CEO was apparently only too happy to wear.

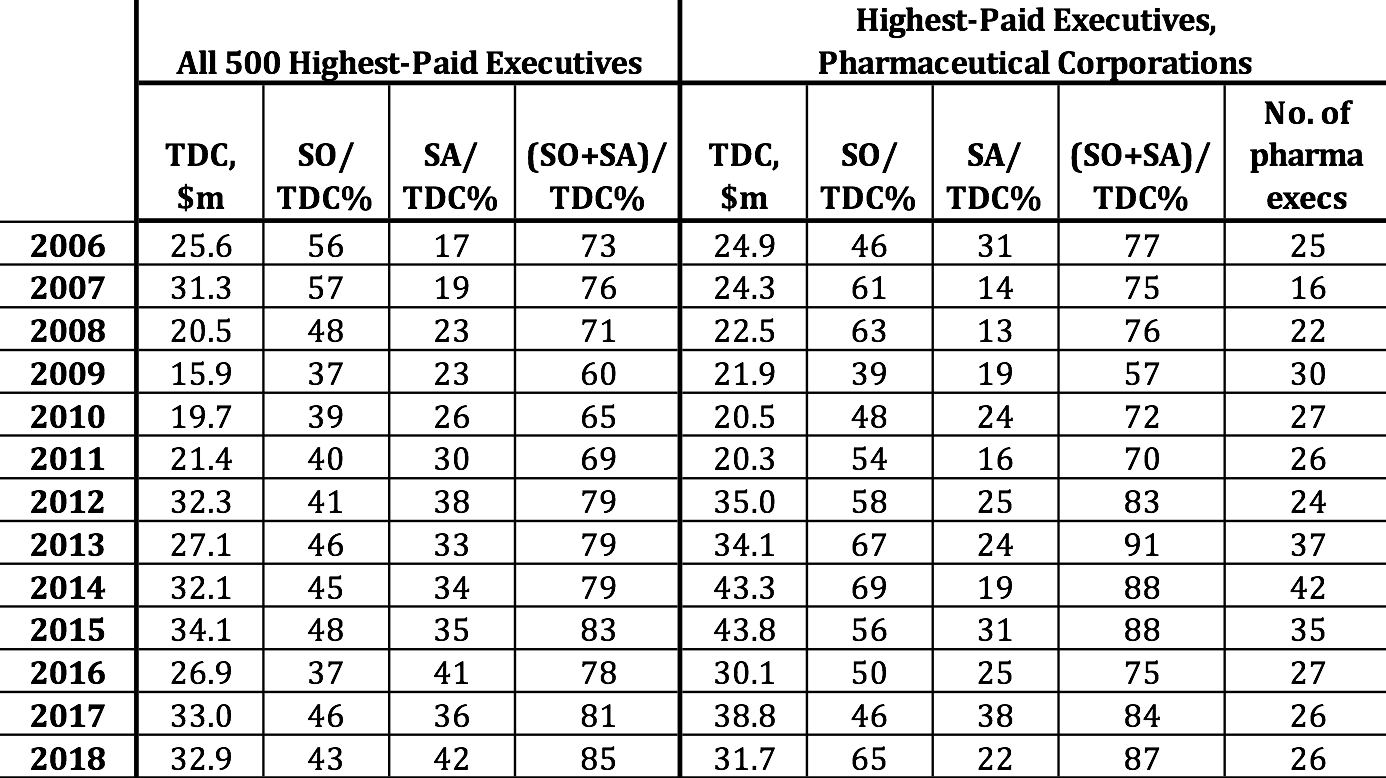

Frazier and Read are by no means outliers as corporate executives who have struck stock-based gold. Table 4 provides data on the average total direct compensation (TDC) of the 500 highest-paid U.S. corporate executives for each year from 2006 through 2018, with the percentages of the total from exercising stock options (SOs) and the vesting of stock awards (SAs). With the stock market booming, supported by massive distributions to shareholders, the proportion of the average remuneration of the top 500 in each year taking the form of stock-based pay was at least 79% since 2012. On average, pharmaceutical executives were 5.6% of the 500 highest-paid executives, reaching as high as 8.4% in 2014. From 2012 through 2017 the average compensation of these pharmaceutical executives outstripped the average of the top 500, fueled by higher proportions of stock-based pay in every one of those years except 2016.

Table 3. Total direct compensation of Kenneth C. Frazier (Merck CEO, 2011-2018) and Ian C. Read (Pfizer CEO, 2011-2018), 2007-2018, and percentage that is stock based Notes: Kenneth C. Frazier became CEO of Merck on January 1, 2011 and remains CEO; Ian C. Read became CEO of Pfizer on December 10, 2011 and stepped down as CEO on January 1, 2019. TDC=Total direct compensation (includes the actual realized gains from exercising stock options and the vesting of stock awards). Source: S&P ExecuComp database, calculations by Matt Hopkins.

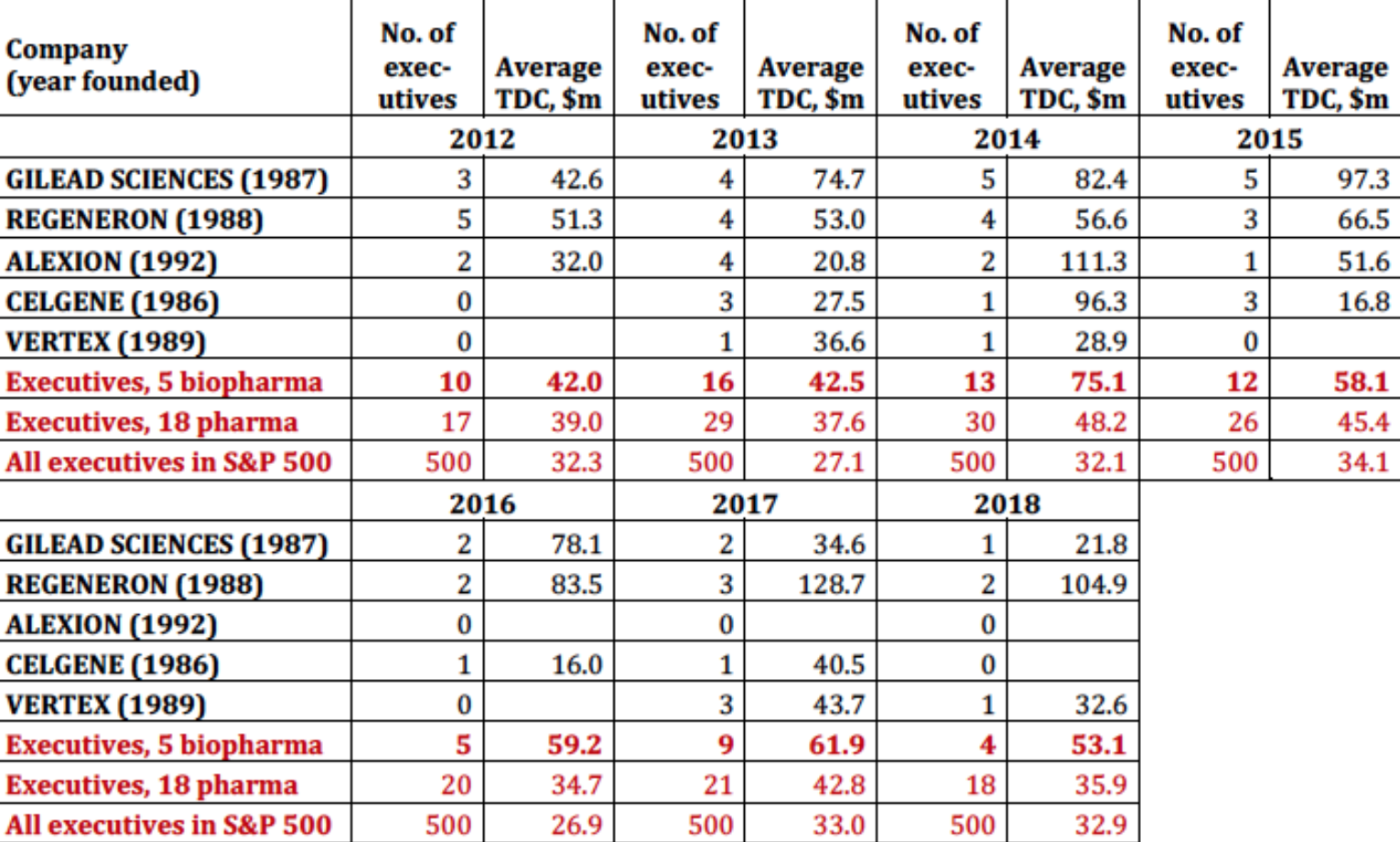

Table 5 shows that, among the 18 pharmaceutical companies in the S&P 500 Index, a younger set of biopharma companies launched in the late 1980s and early 1990s account for much of the explosion in pharmaceutical executive pay. Gilead Science stands out as a pharmaceutical company that has engaged in extreme price gouging to boost its profits, stock price, and executive pay. The financial gains that Gilead has reaped from this strategy with its Sovaldi/Harvoni drugs, which the company acquired at a very advanced stage of development, show up in the astronomical levels of its senior executive pay in 2013-2016. Regeneron is a company that has achieved soaring stock prices and outsize executive pay through the internal development of successful drugs. In both cases, high drug prices and booming stock prices play far too great a role in the operation and performance of pharmaceutical companies.

Table 4. 500 highest-paid executives, U.S. corporations, with proportions of mean total direct compensation from stock options and stock awards, and representation of pharmaceutical executives among the top 500, 2006-2018 Note: TDC=total direct compensation; SO=realized gains from exercising stock options; SA=realized gains from vesting of stock awards. Top 500 sorted by ExecuComp TOTAL_ALT2: salary, bonus, nonequity, change in pension value, realized gains from stock options and stock awards. Pharmaceutical executives are from companies with NAICS 325411, 325412, 325413, 325414. Note that some of the pharma executives are at companies that are not among the 18 pharma companies in the S&P 500 Index, identified in Table 1. Source: S&P ExecuComp database, calculations by Matt Hopkins.

Table 5. Biopharma and the explosion of executive pay, 2012-2018 Note: TDC=total direct compensation Source: S&P ExecuComp database, calculations by Matt Hopkins.

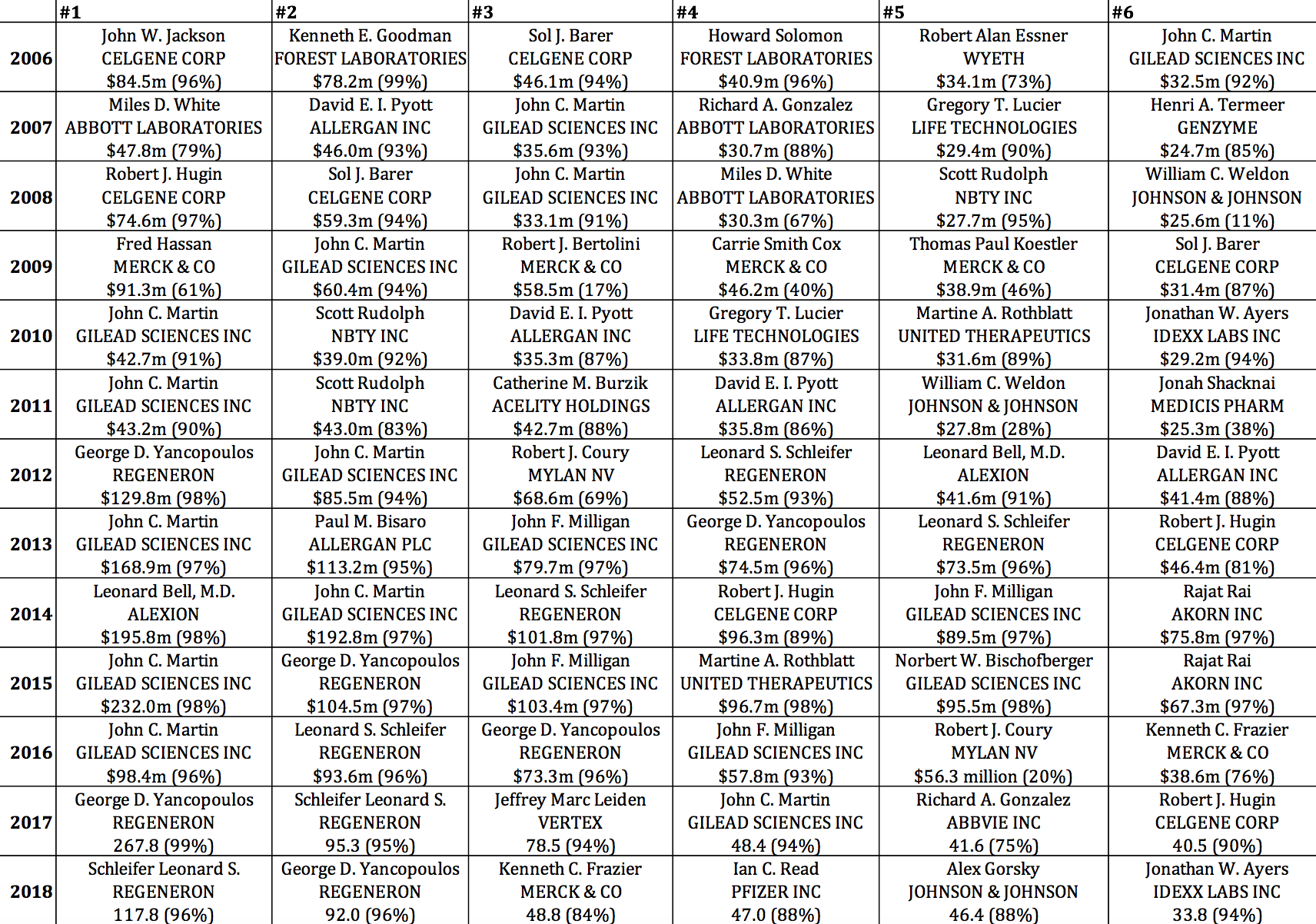

Table 6, which selects from all pharmaceutical executives in the S&P ExecuComp database (and not just from those companies in the S&P 500 Index in January 2019), identifies the six highest-paid pharmaceutical executives for each year from 2006 through 2018. Note the prominence, especially in 2013-2016, of executives from three of the biopharma companies in Table 5: Gilead Sciences (17 of the 78 cells), Regeneron (12), and Celgene (8). Also note the extent to which their pay is stock based. Gilead Sciences CEO John C. Martin appears on this top-six list in 12 years, including five times in first place, three times in second, and twice in third. The established companies known as Big Pharma, including Wyeth, Abbott, Johnson & Johnson, and Merck, were better represented among the top six in the earlier years, including four from Merck in 2009. Most recently, 2018 was a bountiful year for Big Pharma executives, with the CEOs of Merck, Pfizer, and Johnson & Johnson at numbers 3, 4, and 5 respectively.

Table 6. Six highest-paid pharmaceutical executives, 2006-2018, with total direct compensation in millions of dollars (stock-based pay as percent of total direct compensation) Source: S&P ExecuComp database, calculations by Matt Hopkins.

U.S. government support for the pharmaceutical industry[13]

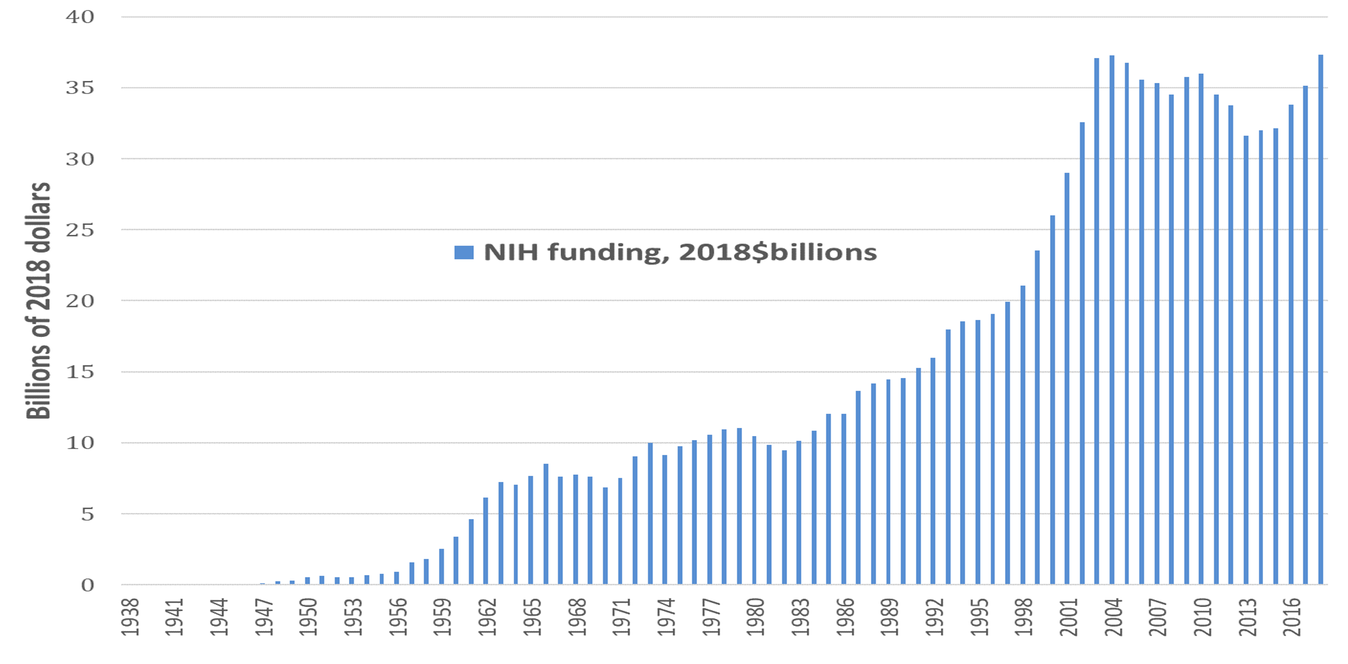

Dating back to the Morrill Land Grant Act of 1862, which created the national system of public universities, the U.S. government has put in place the most formidable national system of innovation in history.[14] With the launching of the National Institutes of Health (NIH) in the 1930s, this national innovation system included a focus on pharmaceutical drug development. The 2019 NIH budget is $39.3 billion, up from $37.3 billion in 2018.[15] Figure 1 shows NIH spending, measured in 2018 dollars, on life-sciences research from 1938 through 2018, for a cumulative total of $1.122 trillion over these 81 years. Note the virtual doubling of the NIH budget in real terms between 1996 and 2004. Since then, in real dollars, total NIH funding has been about twice its level in the mid-1990s and three times its level in the mid-1980s. Recent research by Ekaterina Cleary and colleagues at Bentley University documents that “NIH funding contributed to every one of the [210] NMEs [new molecular entities] approved from 2010-2016 and was focused primarily on the drug targets rather than on the NMEs themselves.”[16]

Figure 1. National Institutes of Health funding 1938-2018, 2018$ billion Source: National Institutes of Health (NIH) Budget, at https://www.nih.gov/about-nih/what-we-do/budget.

NIH funding forms a foundation for the elaborate sets of laws and institutions that define the U.S. system of drug innovation. The Patent and Trademark Law Amendments Act of 1980, commonly known as the Bayh-Dole Act, explicitly permits research institutes, including the nation’s leading research universities, to transfer the results of federally funded research to commercial entities. Although the Bayh-Dole Act was initially designed to give small businesses easier access to taxpayer-funded technologies carried out in university labs, the bill later expanded beyond universities to include all non-profit research organizations while dropping the term “small” to include all businesses, including large defense contractors.

The Stevenson-Wydler Technology Innovation Act of 1980 authorized the establishment of Cooperative Research Centers (CRCs) to encourage industry-university collaboration and mandated that each federal laboratory establish an Office of Research and Technology Applications to actively engage in technology transfer from the labs to commercial enterprises. When Ronald Reagan became U.S. President, he declined to fund the CRCs on the grounds that the provisions of the Bayh-Dole Act offered universities more autonomous discretion in the licensing of federally funded research.

President Reagan later signed the 1986 Federal Technology Transfer Act (FTTA) to eliminate weaknesses of the Bayh-Dole Act and Stevenson-Wydler Act pertaining to the transfer of federally funded research to industry. The FTTA created the “cooperative research and development agreement” (CRADA) to foster the interaction of government and business research efforts, quicken the transfer of technology to business enterprises, and make it easier for businesses to file patents based on this cooperative research. Through CRADAs, FTTA eliminated any constraints on federal laboratories’ actively seeking partnerships with industry. In particular, this act facilitated the transfer of military-sponsored research to civilian uses. Most of the direct benefits of the Bayh-Dole Act, the Stevenson-Wydler Act, and FTTA (CRADAs) have gone to small biotechnology start-ups and the nation’s leading research universities. In 2010, on the occasion of the 30th anniversary of the Bayh-Dole Act, it was revealed that 154 FDA-approved drugs had been discovered, partly or wholly, by government-sector research institutions, with an estimated sales volume of $103 billion.

The original intention was that the federal government could use CRADAs to influence the quality and price of commercial products by requiring that a licensed technology serve the health and safety needs of the public and that the products be “reasonably priced.” Unfortunately, CRADAs became opaque and ineffective instruments of price regulation that undercut demands for the open and direct regulation of drug prices. The “reasonably priced” clause persisted when the federal technology transfer program was reauthorized under the National Competitiveness Technology Transfer Act of 1989. But it was removed with the National Technology Transfer and Advancement Act (NTTAA) of 1996, which amended the Stevenson-Wydler Act to make it more attractive for drug companies to enter into CRADAs. While it lifted restrictions on pharmaceutical drug pricing, NTTAA placed a cap on the amount of royalties that federal researchers could receive on their inventions. After the removal of the “reasonably priced” clause, the number of CRADA applications increased significantly. The new, amended version of the Stevenson-Wydler Act allowed more exclusivity to licensees under a CRADA agreement.

Patent protection has been fundamental to the U.S. innovation system. The pharmaceutical industry has benefited from general patent laws, including the 17 years’ protection against competition from the time of filing a successful patent that prevailed from 1861 through 1994 and the 20 years’ protection that has been in effect since 1995. In addition, there have been special protections applicable to the pharmaceutical industry. Following the recombinant DNA revolution of the 1970s, the U.S. Supreme Court ruled in 1980 in Diamond v. Chakrabarty that a genetically modified bacterium could be patented.

Following the Supreme Court ruling in favor of Ananda Chakrabarty, as well as the enactment of Bayh-Dole, patenting activities in drug development increased rapidly. Enabling this growth were radical changes in the judicial process that put any court appeal concerning patent litigation under the jurisdiction of a single, nationwide appellate court, specialized in patent-related matters. Patent attorneys overwhelmingly supported the new judicial reform, which, despite opposition from some stakeholders, cleared the House and Senate in 1981. President Reagan signed the Court of Appeals for the Federal Circuit (CAFC) Act, which came into effect in 1982. Made up of judges who were former patent attorneys, the Court’s “patent-friendly” attitude favored the intellectual-property rights of patent-holders.

The Orphan Drug Act (ODA) of 1983 provided financial subsidies and market protection for pharmaceutical companies to develop drugs for rare and genetic diseases. Lazonick and Tulum have shown that these so-called orphan drugs were the foundation for pharmaceutical revenue growth in the 1990s and 2000s.[17] From the law’s enactment in 1983 through November 21, 2019, there were 5,173 ODA designations and 836 approvals.[18] ODA also offers R&D tax credits as well as FDA assistance in ensuring the rapid transformation of a promising therapy into an approved marketable drug. Most important, ODA incentives include seven-year marketing exclusivity for a specific therapeutic application. Unlike patent protection, which begins at the outset of the drug-discovery process, ODA exclusivity begins once the drug has been approved for sale by the FDA. Moreover, the company that has obtained ODA approval does not necessarily require patent protection to have market exclusivity in selling the drug. Orphan drugs, which have typically come with very high price tags, were central to the growth of the leading companies in the biopharmaceutical drug industry, including Amgen, Genentech, Genzyme, Biogen IDEC, Cephalon, and Allergan. Large pharmaceutical companies have also benefited from orphan drugs, either by acquiring smaller biopharma companies or by entering into co-marketing deals with them that entail both equity investments and research contracts critical to funding the quest to develop an approved orphan drug.

With all of the government funding and market protection provided to the pharmaceutical industry, one might assume that the U.S. government would regulate drug prices. But, relying on the tenets of neoclassical economics, the industry has made the argument that it should be the market, not the government, that determines drug prices. It has argued that the market mechanism could kick in when a drug went off patent, with producers of generics entering the commercial fray to compete for market share. This market-directed “regulatory” approach was put into force by the Drug Price Competition and Patent Term Restoration Act of 1984, often referred to as the Hatch-Waxman Act. Competition from generics works in some cases and to some extent, although even then it takes 20 years from the filing of a patent to the time open competition from generics can take place. Although the market entry of generics makers induces some downward pressure on drug prices at first, the patented-drug producers often use some of their monopoly profits to bribe generics producers not to enter the market when a drug goes off-patent.[19] Additionally, as the growing merger-and-acquisition activity in the generic drug business consolidates the entire sector into fewer major players, the prospects of price competition among generics manufacturers has declined.

When threats of drug-price regulation arose in the 1990s, the established pharmaceutical companies, known as “Big Pharma,” and the rapidly growing New Economy biopharma companies joined forces to defeat this “interference” with so-called “market forces.” In 1994, in the wake of renewed Congressional attention to high drug prices, the Pharmaceutical Manufacturers Association changed its name to the Pharmaceutical Research and Manufacturers of America, or PhRMA, to emphasize that its members were engaged in research activities for the benefit of the U.S. public.

One year after this name change, PhRMA helped to persuade U.S. lawmakers to extend patent protection from 17 years to 20 years, which was in line with changes in intellectual property rights advocated by the World Trade Organization. Focused on securing every possible advantage of government support for the industry while avoiding price regulation, PhRMA has become one of the most powerful lobbies in Washington, D.C. A major policy coup of PhRMA was the Food and Drug Administration Act of 1997, which removed any regulatory restriction on television broadcasting of drug information; allowed the drug companies to provide medical professionals with some information in peer-reviewed academic journals on the off-label use of any prescription drug; and granted drug companies an additional six months of data exclusivity on pharmaceutical products developed for children. With the passing of this legislation, direct-to-consumer pharmaceutical advertising went from $360 million in 1995 to $1.3 billion in 1998 and $5.0 billion in 2006.

PhRMA is one of more than 500 members of Research!America (R!A), formed in 1989 for the purpose of advocating public support for biomedical research.[20] R!A quickly became the umbrella organization for all the stakeholders of NIH funding, including major research universities and academic institutes, Big Pharma and other drug companies, disease advocacy groups, and professional societies. In 1992 R!A was at the forefront of lobbying for the Prescription Drug User Fee Act, under which the FDA could charge drug companies fees for reviewing drugs for approval in exchange for faster review times. Along with R!A, PhRMA played a key role in the successful lobbying efforts to double NIH funding in the late 1990s and early 2000s. This expansion of the NIH, along with the growing support for life-sciences research from non-governmental sources, resulted in the rapid expansion of physical infrastructure to support research to develop innovative therapies. Subsequent to the doubling of the NIH budget in the early 2000s, the 21st Century Cures Act of 2016 was the first major legislative effort to increase funding for the NIH, and included $1.8 billion in new funding over seven years to the National Cancer Institute for the Cancer Moonshot, sponsored by former Vice President Joe Biden.

Confronting financialization

Pharmaceutical drugs are often a matter of life or death. It should be a prime objective of government policy to rid the industry of financialization. Here are five actions that government policy can take:

1. Regulate drug prices. If business enterprises are to avail themselves of the types of government support that we have outlined and sell products to people for whom these drugs are necessities, they must be subject to price regulation. Given that drug development is both expensive and uncertain, the setting of drug prices such that safe, effective, and affordable medicines are produced is a complex socioeconomic issue. Our ongoing work on this issue seeks to apply “the theory of innovative enterprise” to the question of price-setting in the pharmaceutical industry.[21]

2. Ensure that companies “retain-and-reinvest.”[22] The paramount purpose of a pharma-ceutical company is to research and develop safe, effective, and affordable medicines. Doing so requires investments in organizational learning. It is the innovative success of a company in researching and developing safe, effective, and affordable drugs that is the legitimate source of business profits. Those innovative enterprises then possess unique organizational capabilities for repeating that process in new applications. To engage in continuous innovation, these companies must be compelled to retain a substantial proportion of their profits as the financial foundation for reinvestment in the productive capabilities that can address our medical needs.

3. Ban stock buybacks done as open-market repurchases. SEC Rule 10b-18, adopted in November 1982 is a “license to loot.”[23] With its adoption, the SEC turned from being a regulator of the stock market to a promoter of the stock market. Companies can remain within Rule 10b-18’s “safe harbor” against charges of stock-price manipulation even while repurchasing huge amounts of their stock: On any given trading day, for example, Johnson & Johnson can do about $286 million in buybacks, Merck $185 million, and Pfizer $166 million. And they can engage, with impunity, in this level of manipulative activity trading day after trading day. The Reward Work Act, reintroduced in Congress in March 2019 by Sen. Tammy Baldwin (D-WI), would rescind Rule 10b-18, thus opening up these companies to manipulation charges, and could bring this insidious financial behavior to an end.[24]

4. Eliminate the role of the company’s stock price in executive pay. Senior pharmaceutical executives are employees who lead complex learning organizations and should be paid in line with the employees whom they lead. These business corporations are also part of a national innovation ecosystem that, as we have seen, is heavily dependent on taxpayer funding. The drugs that their companies bring to market embody scientific knowledge accumulated over decades, emanating from business, government, and civil-society organizations. The remuneration of senior executives should reflect their value-added, recognizing their important, but limited, roles in a social process of value creation that spans time and place. Their remuneration should not be based on the company’s stock price, which reflects speculation and manipulation far more than the contribution of the business corporation to innovation.[25]

Place public-interest members on corporate boards. Public corporations, including those in pharmaceuticals, should not be run by and for shareholders. Contrary to capitalist folklore, public shareholders do not invest in the productive capabilities of companies. They simply buy and sell shares on a liquid stock market.[26] If one accepts that the primary purpose of a pharmaceutical company is to produce safe, effective, and affordable medicines, then corporate boards should be populated by people who have expertise in and a commitment to the research, development, and distribution of safe, effective, and affordable medicines.

Research for this article has been funded by the Institute for New Economic Thinking. We thank Thomas Ferguson for comments. William Lazonick acknowledges support from the Open Society Foundations as an Open Society Fellow. Lazonick is president and the four co-authors are senior researchers at the Academic-Industry Research Network, a 501(c)(3) research organization. Lazonick is also UMass professor of economics emeritus and a fellow of the Canadian Institute for Advanced Research; Tulum is research affiliate, Rhodes Center for International Economics and Finance, Brown University; Hopkins is a PhD student in economics at SOAS University of London, and Sakinç is assistant professor of economics, University of Paris 13.

This article updates data provided in previous publications:

· William Lazonick, Matt Hopkins, Ken Jacobson, Mustafa Erdem Sakinç, and Öner Tulum, “U.S. Pharma’s Financialized Business Model,” Institute for New Economic Thinking Working Paper No. 60, revised September 8, 2017, at https://www.ineteconomics.org/research/research-papers/us-pharmas-financialized-business-model.

· Öner Tulum and William Lazonick, “Financialized Corporations in a National Innovation System: The US Pharmaceutical Industry,” International Journal of Political Economy, 47, 3-4, 2018: 281-316.

The reader should consult these two publications for specific bibliographic references to data and details of arguments contained in this article.

Notes

[1] United States Census Bureau, “2016 SUSB Annual Data Tables by Establishment Industry,” December 2018, at https://www.census.gov/data/tables/2016/econ/susb/2016-susb-annual.html.

[2] William Lazonick and Jang-Sup Shin, Predatory Value Extraction: How the Looting of the Business Corporation Became the U.S. Norm and How Sustainable Prosperity Can Be Restored, Oxford University Press, 2020; Ken Jacobson and William Lazonick, “A License to Loot: Opposing Views of Capital Formation and the Adoption of SEC Rule 10b-18,” The Academic-Industry Research Network, in progress, November 2019.

[3] See the articles and comments at https://www.ineteconomics.org/research/experts/wlazonick and https://hbr.org/search?term=william+lazonick. See also William Lazonick, “Stock Buybacks: From Retain-and-Reinvest to Downsize-and-Distribute,” Center for Effective Public Management, Brookings Institution, April 2015 at https://www.brookings.edu/research/stock-buybacks-from-retain-and-reinvest-to-downsize-and-distribute/; William Lazonick, “Innovative Enterprise and Sustainable Prosperity,” The Academic-Industry Research Network, January 2019, at http://www.theairnet.org/v3/backbone/uploads/2019/03/Lazonick-IESP-20190118.pdf; William Lazonick, Mustafa Erdem Sakinç, and Matt Hopkins, “Stock buybacks and the fragile economy,” Harvard Business Review Blog, forthcoming,

[4] Sari Horwitz, “Drug industry accused of gouging public,” New York Times, July 16, 1985, p. E1.

[5] PhRMA, “Biopharmaceuticals in Perspective,” Summer 2019, p. 2, at https://www.phrma.org/-/media/Project/PhRMA/PhRMA-Org/PhRMA-Org/PDF/PhRMA_2019_ChartPack_Final.pdf

[6] Öner Tulum, Innovation and Financialization in the U.S. Biopharmaceutical Industry, PhD dissertation, University of Ljubljana, June 2018, at http://www.cek.ef.uni-lj.si/doktor/tulum.pdf; Tulum and Lazonick, “Financialized Corporations in a National Innovation System”; Öner Tulum, Antonio Andreoni, and William Lazonick, “A Healthy Industry? Innovation, Financialization, and Productivity in UK Pharmaceuticals, SOAS University of London, working paper, November 2019.

[7] See Matthieu Montalban and Mustafa Erdem Sakinç, “Financialization and Productive Models in the Pharmaceutical Industry,” Industrial and Corporate Change, 22, 4, 2013: 981-1030.

[8] Lazonick and Shin, Predatory Value Extraction, chs. 4-7.

[9] Jonathan D. Rockoff, Dana Mattioli, and Dana Cimilluca, “Pfizer and Allergan begin merger talks,” Wall Street Journal, October 29, 2015, at https://www.wsj.com/articles/pfizer-allergan-considering-combining-1446079506;

[10] William Lazonick and Öner Tulum, “Global tax dodging just one part of Pfizer’s corrupt business model,” Institute for New Economic Thinking Blog, December 3, 2015, at https://www.ineteconomics.org/perspectives/blog/global-tax-dodging-just-one-part-of-pfizers-corrupt-business-model.

[11] William Lazonick, “We stopped Pfizer’s tax dodge, now let’s end the buybacks,” Institute for New Economic Thinking Blog, April 8, 2016, at https://www.ineteconomics.org/perspectives/blog/we-stopped-pfizers-tax-dodge-now-lets-end-the-buybacks.

[12] William Lazonick, “Congress can turn the Republican tax cuts into new middle-class jobs,” The Hill, February 7, 2018, at https://thehill.com/opinion/finance/372760-congress-can-turn-the-republican-tax-cuts-into-new-middle-class-jobs.

[13] This section draws on Tulum and Lazonick, “Financialized Corporations in a National Innovation System.”

[14] Matt Hopkins and William Lazonick, “Who Invests in the High-Tech Knowledge Base?” Institute for New Economic Thinking Working Group on the Political Economy of Distribution Working Paper No. 6, September 2014 (revised December 2014) at https://www.ineteconomics.org/ideas-papers/research-papers/who-invests-in-the-high-tech-knowledge-base

[15] Congressional Research Service, “National Institutes of Health (NIH) Funding, FY1994-FY2020,” April 4, 2019, at https://fas.org/sgp/crs/misc/R43341.pdf.

[16] E. Galkina Cleary, J. M. Beierlein, N. S. Khanuja, L. M. McNamee, and F. D. Ledley, “Contribution of NIH Funding to New Drug Approvals 2010-2016,” Proceedings of the National Academy of Sciences, 115, 6, 2018, at https://www.ncbi.nlm.nih.gov/pubmed/29440428.

[17] William Lazonick and Öner Tulum, “US Biopharmaceutical Finance and the Sustainability of the Biotech Business Model,” Research Policy, 40, 9, 2011: 1170-1187

[18] U.S. Food and Drug Administration, “Orphan Drug Designations and Approvals, “ at https://www.accessdata.fda.gov/scripts/opdlisting/oopd/.

[19] Joshua M. Sharfstein and Jeremy Greene, “Promise and Peril for Generic Drugs,” JAMA Internal Medicine, 176, 6, 2016: 733-734; Kerstin Noëlle Vokinger, Aaron S. Kesselheim, Jerry Avorn, and Ameet Sarpatwari. “Strategies that Delay Market Entry of Generic Drugs,” JAMA Internal Medicine, 177, 11, 2017: 1665-1669.

[20] See Research!America, at https://www.researchamerica.org/

[21] William Lazonick, “The Theory of Innovative Enterprise: A Foundation of Economic Analysis,” The Academic-Industry Research Network, AIR Working Paper #13-0201, revised August 2015, at http://www.theairnet.org/v3/backbone/uploads/2015/08/Lazonick.TIE-Foundations_AIR-WP13.0201.pdf.

[22] Lazonick, “Innovative Enterprise and Sustainable Prosperity.”

[23] William Lazonick, “The Curse of Stock Buybacks,” The America Prospect, June 25, 2018, at https://prospect.org/power/curse-stock-buybacks/.

[24] Office of U.S. Senator Tammy Baldwin, “U.S. Senator Tammy Baldwin reintroduces legislation to rein in stock buybacks and give workers a voice on corporate boards,” press release, March 27, 2019, at https://www.baldwin.senate.gov/press-releases/reward-work-act-2019.

[25] William Lazonick, “The Functions of the Stock Market and the Fallacies of Shareholder Value,” Institute for New Economic Thinking Working Paper No. 58, July 20, 2017, at https://www.ineteconomics.org/research/research-papers/the-functions-of-the-stock-market-and-the-fallacies-of-shareholder-value.

[26] Lazonick and Shin, Predatory Value Extraction, chs. 2 and 3.