Italy’s 2018 elections results—with the success of the Five Star Movement, the relative importance gained by the Northern League, and the marked decline and ensuing disaggregation of the Democratic Party—have attracted much international attention and perhaps even caused some surprise. The anti-euro and anti-austerity character of much of the pre-electoral rhetoric of the two parties currently in power almost caused an institutional crisis in the country and generated the reaction, from miffed to arrogant, of various European leaders and commentators.

In this brief contribution we will not aim at a sociological and political analysis of the vote, for which we have no competence, but provide some data on the macroeconomic trends, and on inequality and income distribution in the last decade and some further information on what was going on before the 2008 crisis. We think these can help clear up some misconceptions and allow us to better understand why a majority of Italians voted clearly against “having more of the same”—even though it may be less clear what they voted for.

We will not touch on the very hot and complex issue of immigration, which is very important in the internal political debate in Italy and other European countries and at the same time so openly reveals European disunity and the inability to join efforts in facing it. Yet we think that the information below can indicate that even without immigration, economic and social problems are such that they might have affected Italian politics in much of the same direction and measure. In other words, we do not think that concern with immigration is necessarily the main reason for Italy’s political turn. Rather, it suggests that in Italy, as in other European countries, austerity policies, labor market deregulation, and the increasing rate of poverty are not compatible with an environment allowing a civilized and orderly management and integration of immigration flows.

Italy’s Double Dip and its Consequences

The 2008 crisis severely hit the Italian economy, as can be seen in Figure 1; yet the initial fall was not much larger than Germany’s.

Figure 1. Italy’s real GDP (billions of constant Euros).

Source: OECD Economic Outlook.

Both countries have a large manufacturing sector, which is known to be more sensitive to fluctuations than the service sector. After the crisis, a recovery had begun, but was interrupted by the European “spread crisis” (that is, falling prices and increasing interest rates on Italian and other ‘peripheral’ countries public bonds in the financial markets) and subsequent inception of more severe austerity policies, that caused a fall in current expenditure and public investment (as documented by Figures 2 to 5) and an increase in overall tax revenues of 18 billion euros in the period 2011-2013, mostly owing to an increase in indirect txation. As a consequence of such measures GDP fell sharply (-73 real billion euros, i.e., -4.5 percentage points), despite some recovery in exports. Industrial production fell much more than GDP: it dropped by one fourth between 2007 and 2009, then recovered 7 points in 2010-11, but fell again subsequently and in 2015 was still slightly below the 2009 level.

Figure 2. Italy’s government current expenditure, including interest payments (billions of constant Euros).

Source: OECD.Stat (COFOG).

Figure 3. Italy’s public investments (billions of constant Euros).

Source: OECD.Stat (COFOG).

Figure 4 and 5. Italy’s government current expenditure by function (billions constant Euros).

Source: OECD. Stat (COFOG).

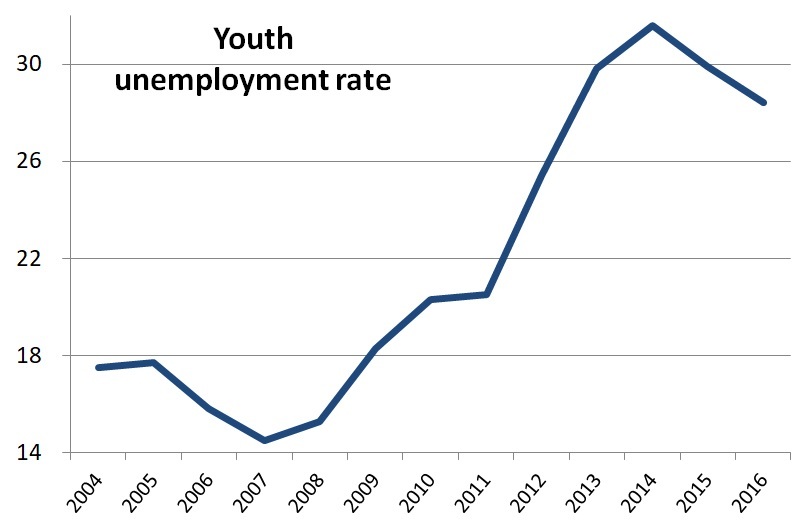

Overall unemployment, that was at 6.2% in 2007, increased from the 8.4% reached in 2010 to 12.4% in 2013 and is currently just below 11%. Youth unemployment (those between 15 and 29 years old) increased by more than 10 points (Figure 6) in two years—between 2011 and 2013—owing to the combination of the fall in GDP and the pension reform. The latter, by postponing the retirement of employed workers, prevented the physiological turnover of the labor force, and hence sharply reduced the opportunities of younger workers to enter employment in substitution of the retiring elderly. The same reform has also caused increasing unemployment among elderly workers who have lost their jobs through the crisis. There are about 500,000 unemployed people over the age of 50 (most of whom have great difficulty in finding employment), more than three times as many as there were in 2006.

Figure 6. Italy’s youth unemployment rate (15-29 years old).

Source: ISTAT

Not only did austerity policies increase unemployment and reduce GDP and household disposable income, but they also hit public services and the welfare state. In particular, the national health service and public education, which may be regarded as two main pillars of the Italian universal welfare system. The first underwent a cut of 7% in real terms between 2011 and 2013, and the second has witnessed a longer term process of diminishing resources, involving a real loss of 20% between 2007 and 2015. This has also involved, among many other things, huge cuts in the financial support granted to well-performing university students coming from low-income families, as well as great difficulties for highly qualified youth in obtaining jobs in the public education and research systems. And yet, both per capita and as a proportion of GDP, Italian public expenditure in these specific areas and also overall (including all services and social protection) currently is, and has always been, below that of other European countries of comparable size and development. Public investment also dropped sharply during the period of austerity, which also visibly reflected on the maintenance of public edifices and infrastructure.

But, one might argue, these measures were necessary in order to curb the high public debt-to-GDP ratio, which was said to be at the roots of the “spread crisis,” and indeed this is how they were sold to the public. On the contrary, as was in fact predictable, austerity policies caused an increase in the debt-to-GDP ratio (Figure 7), reducing national income (the denominator of that ratio) and, accordingly, tax revenues.

Figure 7. Italy’s public debt-to-GDP ratio.

Source: Ameco.

In other words, Italy is a living example of the fact, now widely recognized even by mainstream economists,[1] that fiscal consolidations can have persistent “perverse” effects on the debt-to-GDP ratio—especially when the economy is in a recession and fiscal multipliers are particularly high. According to other interpretations of the crisis, financial market expectations that the European Central Bank (ECB) could not intervene in the public bond market owing to its peculiar statute had a major role in the emerging of the spread crisis, and almost caused the breakdown of the euro owing to persisting inaction on the part of the ECB. At any rate, it was the change in ECB policies, not austerity, that put an end to the crisis.

Actually, austerity caused, and still causes, increasing fragility in the Italian economy, not only as a result of increasing the public debt-to-GDP ratio, but also of shrinking productive capacity in the manufacturing sector and difficulties in the banking sector (see Giacchè, 2017). Concerning the latter, the crisis of the real economy caused an increase in the load of non-performing loans in Italian banks. These in general have been less involved than German and French banks in risky financial market speculations, but more involved in providing credit to households and small and medium firms, which represent a very large share of Italian manufacturing sector. Households and firms have both suffered great losses from the two aforementioned crises—the first crisis due to the international financial breakdown, the second due to austerity policies. Thus, fragility of the banking sector, besides being a problem in itself, also tends to cause persisting difficulties in the access to credit on the part of households and, even more importantly, firms.

Despite some moderate recovery in the last three years, real GDP, employment (measured in standard labor units), and industrial production remain very much lower than their pre-crisis values (from 2007 to 2017, -5.25%; -4.63%; -24.39%, respectively).[2]

If we look at labor and income distribution, Italy has undergone since the 1990s a number of “reforms” concerning wage and labor contracts and labor market (de)regulation. The last of these, passed in 2015, has eliminated all remaining legal protection against unjustified (i.e., with no disciplinary or economic motivation) individual firings, except a relatively small monetary compensation. In addition to that, the continuum of reforms has allowed increasing use of “atypical” and short term contracts. The latter currently account for 16% of the stock of total employees, and 40% of employees between 15 and 29 years old, while involuntary part-timers amount to 2.6 million.

Real wages have been stagnating for a long time: according to OECD data, average gross earnings of employees in real terms are currently almost 1% below 2008 level and only 3% above what they were in 1990. Average gross annual earnings of employees in purchasing power parity are currently lower in Italy (equal to 36,700 dollars) than in France (43,800) and Germany (47,600), and are the lowest in the Eurozone except for Portugal and Greece. Absolute poverty has increased to five million people (8.3% of residents) in 2017; and relative poverty, which amounts to 15% of the population, spreads not only among the unemployed but also among the workers, particularly those who support two or more children. The combination of high unemployment, low pay, and precarious jobs has created, especially, but not only, among younger Italians uncertainty, lack of perspectives, and difficulty in realizing an independent individual and family life.

Trends Before 2008

The analysis of the long term stagnation of the economy is complex.

Unlike other “peripheral” countries in Europe, Italy did not experience an earlier debt-driven “boom” as a result of monetary unification. While countries like Greece and Spain benefitted, albeit temporarily, of (destabilizing) growth springing from large capital inflows from European core countries, which in turn financed increasing indebtedness of the private sector and buoyant growth of domestic demand, similar processes did not materialize in Italy. Although private household debt has increased in Italy too, especially after 2008, it still remains very much below that of most other European countries.

Still, the situation was far from ideal even before the crisis, but the reason does not lie in a lack of austerity measures but rather in a policy trend that has only, yet dramatically, intensified after 2008.

Already before the inception of the euro, in the early 1990s, as part of its target of converging towards monetary unification, Italy pursued fiscal policies involving a primary surplus in the public budget, which has been maintained to the present, with the only exception of 2008 (the public debt-to-GDP ratio was reduced by about 20 points between 1990 and 2007). Accordingly, the dynamic of public spending has been since then much more moderate than that experienced by Germany or France (see Figure 8).

Figure 8. Total government disbursement in real terms (index, 1991=100).*

Source: our elaboration on OECD.Stat, Economic Outlook No 102 - November 2017. * Total disbursement refers to current expenditure plus investment expenditure (gross of interest payments if not differently mentioned).

These trends, combined with a worsening of income distribution, stagnating wages and appreciation of the real exchange rate, particularly vis à vis Germany, have caused stagnating aggregate demand and, as a consequence, stagnating growth in production and, as a result, in productivity. Many studies have in fact documented both in general, and with specific reference to Italian data, that the Kaldor-Verdoorn law holds—that is, that productivity growth, especially in the manufacturing sector, is to a large extent endogenous, and depends on the overall growth of the economy (Millemaci and Ofria 2014). One reason for this, is the dependence of private investments—that have an obviously very important role in the updating of capital equipment and technology—on the growth of aggregate demand (Girardi et al., 2018).

Finally, it should be stressed that Italians, quite in contrast with the prevailing rhetoric according to which they have lived “above their means,” have never benefitted from an exceedingly generous public spending and welfare system. Overall, per capita public expenditure, both net and gross of interest payments, has always been below that of comparable advanced countries, including France and Germany (see Figure 9).

Figure 9. Per capita government disbursement in real terms (net and gross of interest payment).

Source: our elaboration on OECD.Stat, Economic Outlook No 102 - November 2017.

The origins of the high public debt are not to be found in excess spending, and even though tax revenues suffer from a structural problem of tax evasion on the part of the self-employed and firms, the origins of high public debt are mostly to be found in a specific and relatively short period of time, and in the choices then made by monetary authorities. It was during the eighties that Italy saw a doubling of its public debt-to-GDP ratio, which was the consequence of very high real interest rates causing a snowball effect on public debt. Such high interest rates were meant to sustain the commitment to a fixed exchange rate within the Economic and Monetary Union (EMU) by attracting capital inflows from abroad, in the face of a higher rate of inflation than in other European countries, with consequent real appreciation and worsening trade balance. This policy did not, however, succeed in preventing the speculative attack on and devaluation of the Italian lira in 1992, with the subsequent temporary exit from the fixed exchange system. In addition to that, according to some interpretations, the Bank of Italy, by means of such high interest rates, aimed at supporting the profitability of national banks, in order to improve their ability to face intensified international competition in the financial sector. Whatever the motivations, however, the point here is that preoccupation with reducing the burden of public debt since the early 1990s did not entail the reduction of an abnormally high public spending, but rather a poor public sector contribution to demand formation and growth at the macroeconomic level compared with other countries in Europe, as well as less public sector engagement (relatively to other industrial countries) in providing modern infrastructures and services, and public support to investment and technical innovation, thus further contributing to a poor overall performance in terms of productivity growth.

Concluding Remarks

The dismal picture of the Italian social and economic situation contributes in our view to explaining the recent Italian vote. Whether one considers right or wrong the choice made by voters, the main message is that a majority of the population wants a change with respect to the past. This does not mean to say that there is widespread clear awareness of what has been happening. Italian media information on all that concerns economic life is very poor and conformist, generally supporting austerity and deregulation, and arguing that the country’s problems are inefficiency, corruption and excessive—or at least badly designed—spending and taxation on the part of the public sector. But whatever the understanding of the current problems at an intellectual level, people know out of direct experience what their difficulties and problems are. Both the Five Star Movement and the League garnered the votes of millions of working class and middle class people (in many instances past voters for the Democratic Party), and their electoral campaigns contained many promises of sharp changes away from austerity (the Five Star Movement focused on the implementation of a wide system of income support for low income and unemployed people, and on more public investments in the south, while the League emphasized a reduction in taxation by means of a “flat tax;” both parties agreed on the need for revising the 2011 pension reform law to make it less severe), and also from further international trade liberalizations. Whether they will deliver in some measure what they have promised is unclear. But, as already happened with Prime Minister Matteo Renzi a few years ago, unless the current government manages to respond to the needs of a large share of their electorate and make some sensible difference in terms of work opportunities, higher wages, social protection, and public investments in services and infrastructures, the current consensus is likely to rapidly vanish. However, whatever the real, original intentions of the parties now in government, pressures from European institutions and “financial markets,”[3] have already elicited numerous declarations by Italian government members, and particularly the economic minister, that budget rules will be strictly respected, which in turn significantly restricts what can be done to deal with the problems just listed. On the other hand, the initiative on the part of the Five Star Movement leader and minister of labor aimed at moderately reducing labor market deregulation is encountering fierce criticism and opposition by the national employers association (confindustria). But a lot is at stake: if the current government loses popular and electoral consensus, the public will hardly go back to moderate, new-liberal political forces such as the Democratic Party or Berlusconi’s Forza Italia, and tensions within the EU and Eurozone will likely get worse.

References

DeLong, J. B., Summers, L. H., Feldstein, M., & Ramey, V. A. (2012). Fiscal policy in a depressed economy [with comments and discussion]. Brookings Papers on Economic Activity, 233-297.

Ciccone, R. (2012). Austerità, BCE e il peggioramento dei conti pubblici, in Oltre l’austerità, MicroMega.

Fatás, A., & Summers, L. H. (2018). The permanent effects of fiscal consolidations. Journal of International Economics, 112, 238-250.

Nuti, D. M. (2013). Perverse Fiscal Consolidation, Sbilanciamoci.info, 11. English version available here.

Millemaci, E., & Ofria, F. (2016). Supply and demand-side determinants of productivity growth in Italian regions. Structural Change and Economic Dynamics, 37, 138-146.

Giacchè, V. (2017) The Real Cause of the Italian Bank Bailouts and Euro Banking Troubles, https://www.ineteconomics.org/perspectives/blog/the-real-cause-of-the-italian-bank-bailouts-and-euro-banking-troubles

Girardi, D., Paternesi Meloni, W., & Stirati, A. (2017). Persistent effects of autonomous demand expansions. INET working paper No 70.

Footnotes

[1] See DeLong et al. (2012) and Fatàs and Summers (2018); for non-mainstream analyses, see Ciccone (2012) and Nuti (2013).

[2] Real GDP was about 1.686 trillion euros in 2007 and 1.543 in 2017 (OECD), standard labor units passed from 25.125 million to 23.962 (Istat), and the industrial production index from 118.8 to 95.5 (Ameco).

[3] “Financial markets” of course are far from being a set of anonymous small investors, but can be driven by the actions undertaken by a relatively small number of large financial institutions; in turn the latter will be very responsive to the tensions with European Institutions and in particular the attitude of the European Central Bank, since on this depends the “riskiness” (falling prices or re-denomination) of Italian public bonds, and the associated weakness of Italian banks that own large proportions of the latter.