To my mind, this line stands out:

“And because foreigners tend to put their U.S. investments into safe, low-yield assets, America actually earns more from its assets abroad than it pays to foreign investors.”

The US sells low-yielding liabilities and buys higher-yielding foreign assets, and profits on the spread. This is exactly what a bank does. The US as bank of the world is an idea I’ve taken up before. For me the idea comes from Kindleberger, Despres, and Salant, though they may have gotten it from somewhere else.

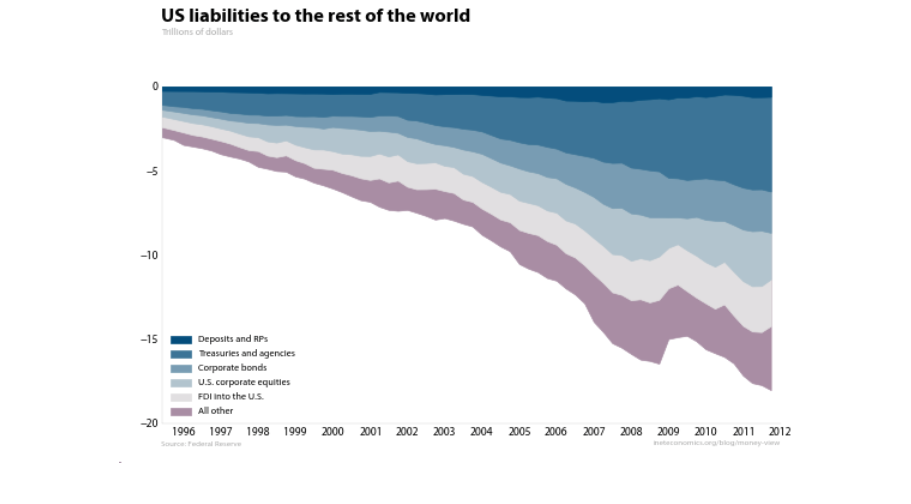

From the flow of funds accounts, we can construct a balance sheet for the US. (Debt owed by US entities to other US entities, including the government, nets out.) First US liabilities:

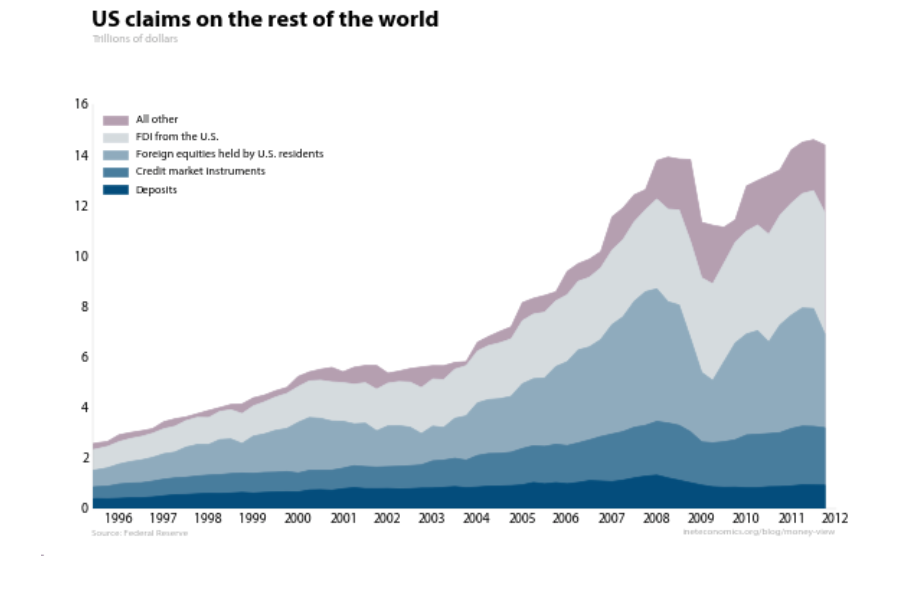

About one third each deposits plus government securities, corporate securities, and everything else. On the asset side:

Some two thirds goes to outbound FDI and foreign equities.

What’s going on here? In decreasing order of liquidity, the US funds itself (to the tune of about $12T) with deposits, government securities, corporate debt, and corporate equities. In increasing order of liquidity, the US acquires foreign equities and FDI, with something left over for foreign bonds and deposits.

The US, in short, is a bank, intermediating between the rest of the world’s savers, who want liquid US liabilities, and the rest of the world’s borrowers, who wish to fund illiquid investments. The US is selling liquidity, and the price of that liquidity is net foreign investment income. Foreign savers forgo higher returns so as to be able to hold liquid claims on the US.

Krugman looks at US external debt and finds it benign: what we owe abroad costs us less than we earn on what we own abroad. But the big risk that banks face is illiquidity—the sudden inability to raise funds. If the US is a bank, could it fall victim to a bank run?

In a Jimmy Stewart bank run, depositors want to stop lending to the bank and be paid in a better form of money—cash, say. The bank fails because its assets are illiquid, and can’t be readily turned into cash.

A run on the US is hard to imagine. What better money would creditors be seeking out? Euros? Renminbi? For now, the world wants liquidity and there is no better source than the US.