Today’s Financial Times article: Non-US banks gain from Fed crisis fund (Dec 27)

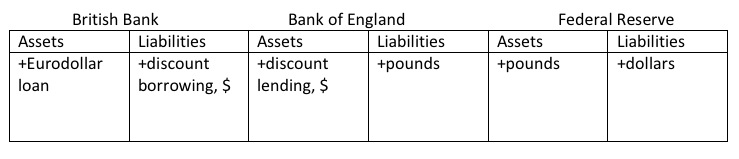

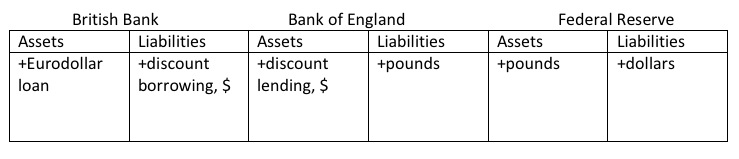

We know that, after the collapse of Lehman and AIG in September 2008, the Fed’s liquidity swap facility with other central banks swelled quickly to about $600 billion. The whole point of that facility was to provide dollar funding to non-US banks. The foreign central banks simply served to channel the funds.

We also know that, as early as Fall 2007, non-US banks were bidding strongly for dollar funding in the Eurodollar market, driving the spread between LIBOR and the Fed Funds rate to unprecedented levels. The non-US banks, just like the US banks, had made lending dollar funding commitments that were being called in, and they were scrambling to find the funds. At this stage, however, the source of the funds was their US correspondents, not the Fed.

In Fall 2007, the Fed was not lending much, but it was encouraging the lending by backstopping the Fed Funds market, driving the target Fed Funds rate down from 5% to 2%, using daily intervention in the Treasury repo market to keep the Fed Funds rate from being bid up along with the Eurodollar rate.

Now comes the news that the Term Auction Facility, created in December 2007 as a kind of anonymous discount window, lent on a fully collateralized basis directly to non-US banks. Personally, I did not know this until the disclosure, but I am not surprised. I had thought that TAF was lending only to the New York correspondents, who were marking it up and on-lending the money to the non-US banks. So it was new information for me, but not surprising information.

In other words, anyone who was paying attention knew quite well that the Fed was lending indirectly to non-US banks, using domestic banks and then foreign central banks as conduits. It could hardly be otherwise. The Fed is lender of last resort for the domestic dollar funding markets; inevitably it serves also as lender of last resort to the international dollar funding market.