Ever since the Global Financial Crisis, increasing numbers of economists have voiced their skepticism about Dynamic Stochastic General Equilibrium (DSGE) models. The ranks of the doubters include many economists of differing views, including, for example, George Akerlof, Olivier Blanchard, Andrew Haldane, Gregory Mankiw, Joseph Stiglitz, Lance Taylor, as well as frequent INET article contributors such as Sheila Dow and Servaas Storm.

The thrust of the collective concern is that New Consensus-type DSGE models stand on shaky foundations due to (1) the use of micro-unfounded axiomatic assumptions contradicting reality too gravely; (2) their reliance on a shocks paradigm, and the shocks being questionable in terms of quantitative relevance (first and foremost regarding productivity shocks); (3) the missing role of debt (money), or banks being modeled, if at all, mistakenly as intermediaries instead of as money creators; (4) the reliance on representative agent structures; and (5) the models’ high and rising mathematical complexity that doesn’t seem to balance well with what they help us learn. These concerns are as relevant today as they were right after the global financial crisis.

A recent paper (Gross, 2022) attempts to consider alternatives, a model and theoretical reasoning involving the most minimal assumptions possible and designed in a way to not become subject to any of the five concerns afflicting New Keynesian models as listed above. It was developed to throw light on a series of closely related questions: What are the root causes of economic cycles? And, once they exist, what amplifies or dampens them? Despite the model’s great simplicity, self-evolving business cycles emerge and the model replicates six essential macro-financial stylized facts.

The fundamental features that give rise to endogenous cycles in the model include: (1) interest-bearing debt, coupled with (2) a degree of downward nominal wage rigidity. The former is an institutional reality; the latter is a behavioral one, for which a plethora of theoretical and supportive empirical research was developed almost a century-long since Keynes. The model reflects much of Minsky’s (1986/93) financial instability narrative; and aims to go beyond it in explaining the role of interest more fundamentally.

The two structural assumptions are embedded in a multi-agent model with individual firms, households, and a banking system. Banks grant loans to firms to finance investment (wages). Households work at the firms and use their wage and interest income to consume what the firms produce. Profit-maximizing firms face two related contractual financial commitments: the wage bill and debt service, the latter including interest. Sales revenues may at times be insufficient to cover such expenses, in which case firms default on their debt.

The model follows stock-flow consistency principles and involves cross-agent integrated balance sheets (Godley and Lavoie, 2007). This is useful not only for reflecting the endogenous money creation reality adequately and conveniently. It also implies, for example, that wage stickiness induces price stickiness structurally—by having wage contracts in place—without needing any extra assumptions to generate price persistence.

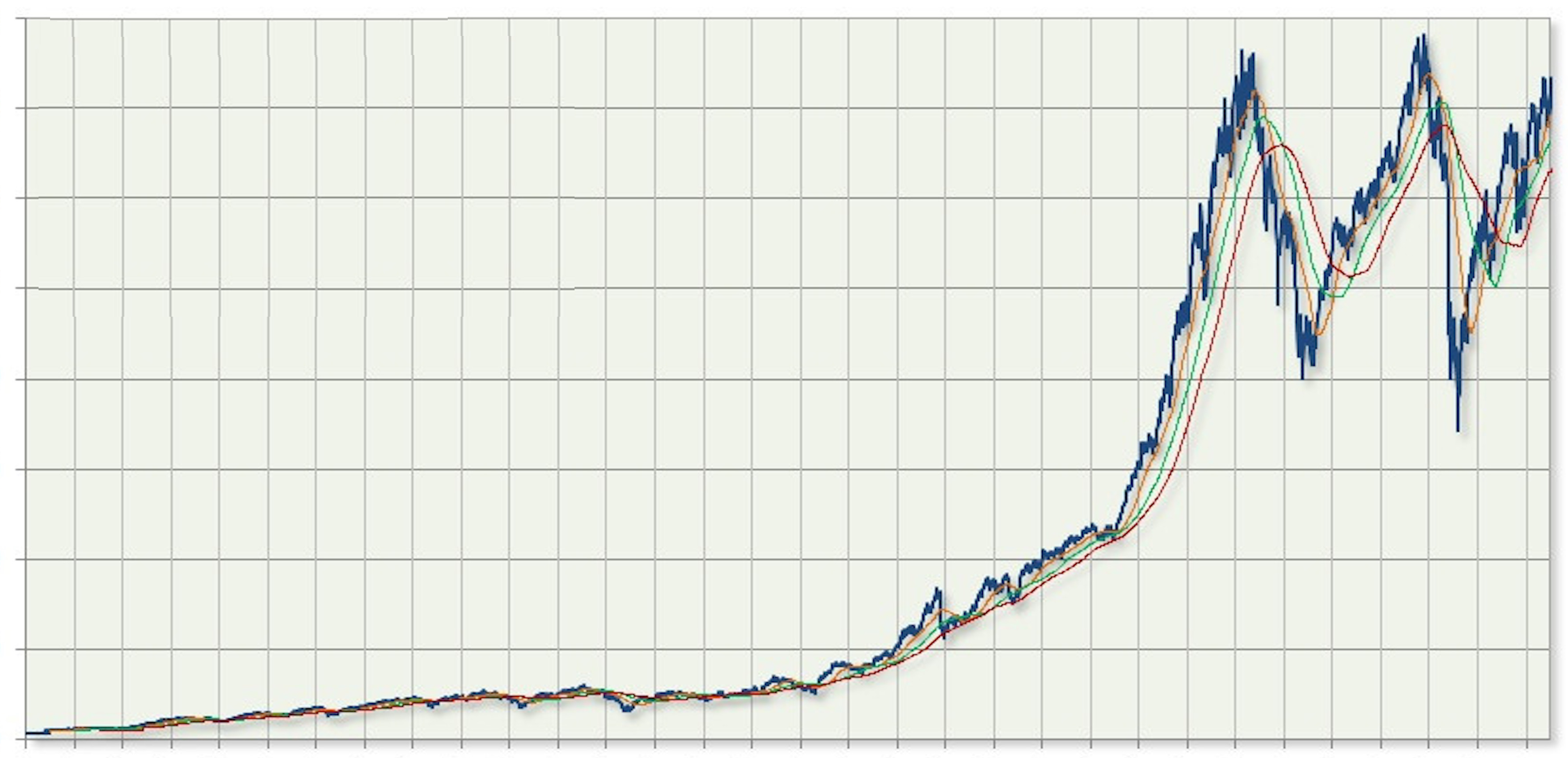

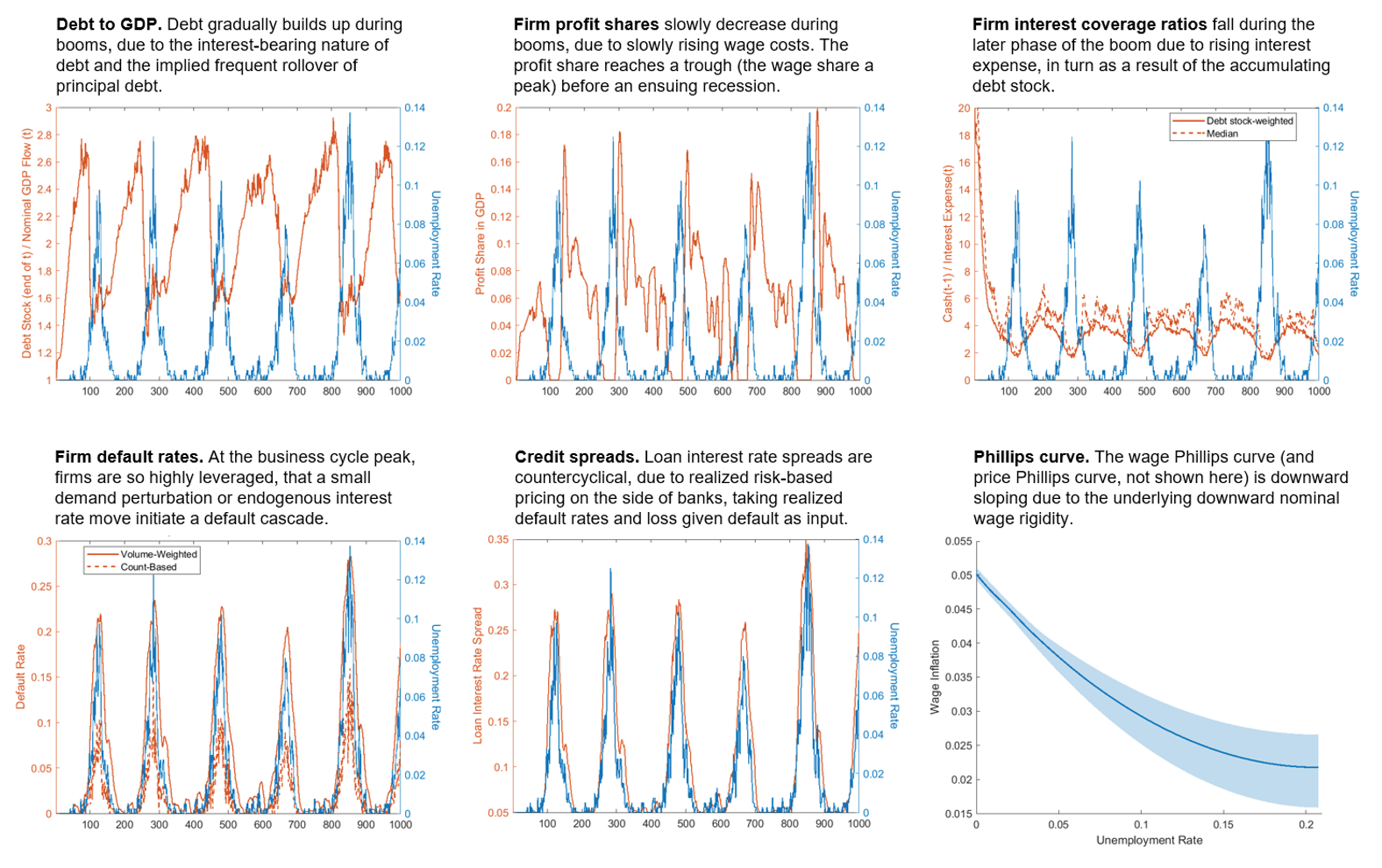

Figure 1 shows a subset of the variables resulting from a model simulation for 1,000 periods. Removing any one of the two structural features—either interest or the downward wage rigidity—lets the cyclical disequilibrium behavior vanish and flat lines result (that is, equilibrium, not shown here but in the paper).

Figure 1: Artificial Data Simulated with the Model Note: The figure shows a subset of the model variables (from Gross 2022) from a model simulation for 1,000 periods. The charts have the simulated unemployment rate on the right axes, as a visual support to gauge the variables’ cyclical behavior. The model was not calibrated to empirical data.

What generates the cycles?

The cycle process captured by the model works as follows: Debt accumulates gradually through booms due to its interest-bearing nature coupled with the downward wage rigidity that sustains the upward slope. Debt is rolled over frequently because the principal debt feeding the economy is insufficient to cover the interest on top, from a system perspective. Throughout the boom, firm profit shares, interest coverage ratios, and credit spreads all fall structurally and bottom out before the turning point to the recession. At the turning point, the system is so stretched (maximally leveraged) that any small demand perturbation or an endogenous interest rate change induces a cascade of firm defaults and associated debt write-offs. The cascade spreads through demand-side feedback, fueled by dropping income and hence declining consumption for the workers that become unemployed. In addition, feedback through rising debt costs due to realized risk-based debt pricing by banks drags yet other firms into default. After the downturn, a new debt accumulation process starts endogenously.

Which stylized facts does the model replicate?

The model replicates six macro-financial empirical facts:

(1) Booms are long, recessions are short-lived.

(2) Leverage is procyclical.

(3) Firm profit and wage shares are counter- and procyclical, respectively.

(4) Wage and price Phillips curves are downward-sloping and convex.

(5) Default cascades arise at the turning points to recessions.

(6) Lending spreads are countercyclical.

Such macroeconomic behavior emerges endogenously “from the bottom up.” It results from combining micro-founded structural features in the model. They are nowhere imposed in a reduced-form manner. Two additional, micro dynamical stylized facts are described in the paper.

Why an agent-based model (ABM) structure?

Representative agent models operate with sector aggregates, regardless of whether we talk DSGE or alternatives, such as nonlinear system dynamics models of a Post-Keynesian kind (which generally tell valuable narratives of course). This implies that default of agents cannot be considered, as a full sector defaulting, a firm sector, for instance, would imply that the whole economy would crash (that is, GDP would drop to literally nil). The multi-agent structure instead allows for defaults by individual agents. This in turn is key for the cycles to emerge from the model the way they do, by interrupting the cyclically recurring debt accumulation process in a partial manner, while not implying complete breakdowns.

Worth an emphasis: The agent-based model structure is a methodology, as econometrics, a neutral means to approach any economic theory, and not being confined to only economics but useful for other fields of science as well. Equilibrium-oriented economic theories can also be reflected therein, although without agent heterogeneity there may be little point in doing so. The choice of an ABM methodology was goal-oriented, without preconceptions. Had other methodologies been more instrumental for the objective at hand, they would have been considered.

What was not required for generating the cycles?

A list in response is long by virtue of such a question. One category includes axiomatic, micro-unfounded assumptions, such as the rational expectations assumption, which is not part of the model. A second category concerns features that are “relevant realities,” but were not required to let the model generate the behavior of interest. Examples include firms’ inventory management and consumers’ buffer-stock savings behavior. Had such or other elements been incorporated, space would have been required to show that these are not among the preconditions for cycles to emerge, by switching them off again.

“Small shocks, large cycles”—A puzzle?

No, the “small shocks, large cycles puzzle,” so-called in Bernanke et al. (1996), is not a puzzle in the model but is easily explained. At the cycle’s peak, a small perturbation, for example via demand fluctuations or an endogenous interest rate move (not a policy mistake, at least not necessarily so), let the firms standing closest to the edge fall over and initiate the economy-wide default cascade. More sizable exogenous shocks may also occur; for example, pandemics. The more severe they were, the more independent their impact would be of the cyclical position by the time they happen.

What amplifies and dampens cycles once they exist?

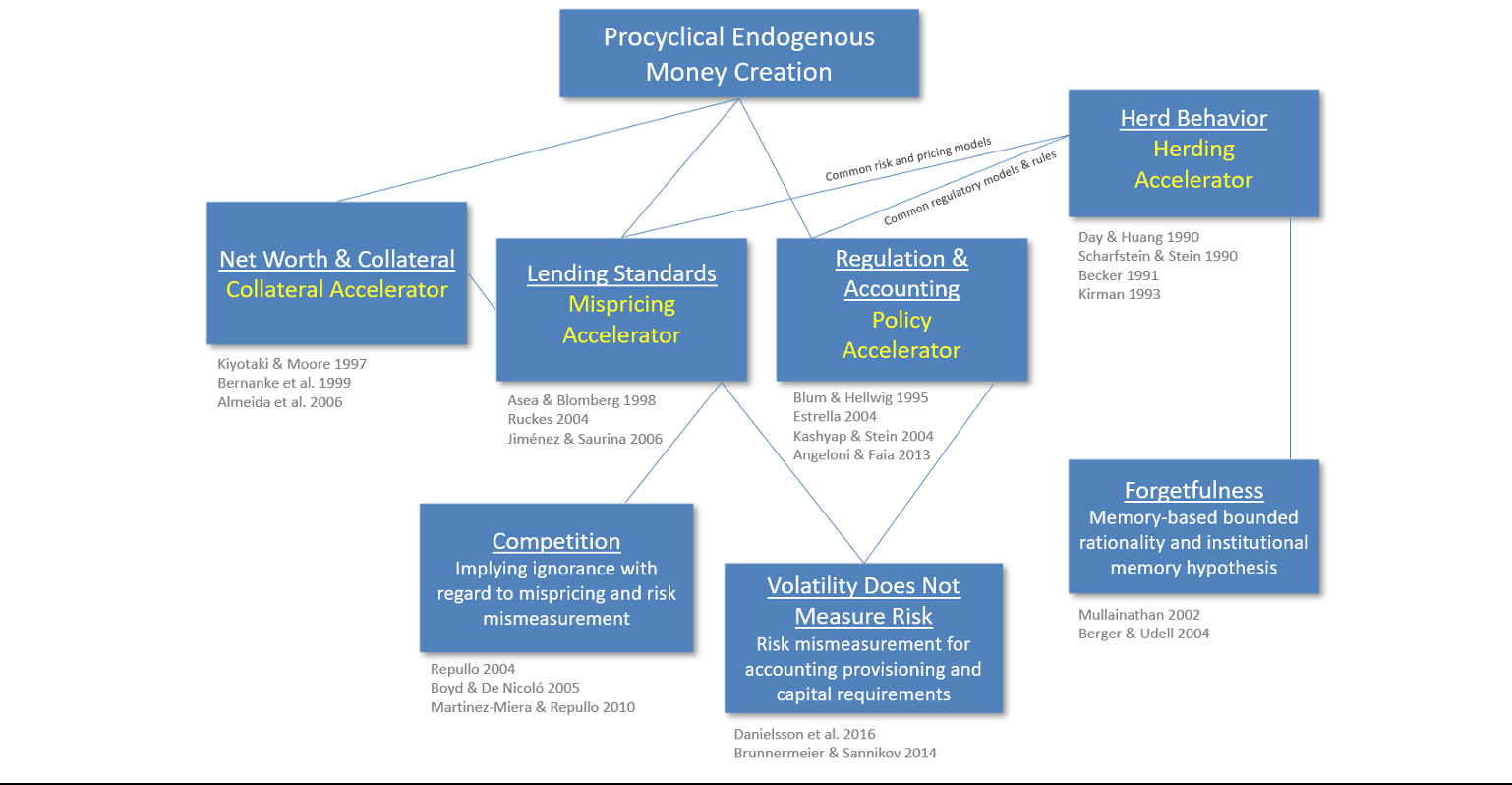

Once the preconditions for cycle emergence are in place, various sources of amplification and dampening influence their shape, that is, their duration and frequency. Four accelerator types are defined (Figure 2).

Figure 2: Sources of Cycle Amplification Source: Figure 12 in Gross (2022)

The collateral accelerator stems from the procyclical value of firms’ net worth (collateral) and squares with the narratives told by Bernanke, Gertler, Kiyotaki, Geanakoplos, and others.

The mispricing accelerator arises from the cost of loans being determined by point-in-time, backward-looking measures of realized defaults and loss given default, serving as input to banks’ debt pricing models. Merton-type models as devised by Moody’s KMV for example—widely used in the financial industry—are based on realized variance, which falls materially enough during booms to dominate rising leverage (the second input to Merton models) and hence suggests falling default probabilities, while risk may in fact be rising when viewing the economy through an endogenous cycle lens, especially when moving closer to the turning points to recessions. Competition meanwhile implies little incentive for a bank to price its credit at terms that better reflect actual risk since it would risk facing a loss in profit and market share.

The policy accelerator pertains to bank regulation and financial accounting. Risk measurement for informing regulatory risk weights and accounting provisions is generally backward-looking, implying their proneness to contribute to procyclicality. The new accounting frameworks, CECL in the U.S. and IFRS 9 in most parts of the rest of the world, are meant to lessen the procyclicality of the past accounting regime and aim to turn them into being countercyclical ideally. Whether they will manage is to be seen and requires research going forward.

The herding accelerator—beyond herding regarding investment behavior in financial markets—can be seen in relation to the other accelerator types insofar as debt pricing models are similar across the banking system, and the accounting and regulatory rules are imposed on and used by banks in a synchronized manner, thus representing a built-in herding mechanism, too. Lastly, there is a tendency for people to forget the lessons of past recessions and crises, relating to the notion of memory-based bounded rationality, implying diminishing awareness and incentive to counteract the sources of the various accelerator types during booms.

Structural sources of amplification, not depicted in the schematic, further stem from network structures: firm interconnectedness through supply chains, bank interconnectedness via interbank lending, and firm-bank cross-connectedness through banks’ lending to the economy. Those all help default cascades triggered in one part of the economy to propagate in a more amplified manner than otherwise. A form of indirect network connectedness through demand-side feedback is reflected in the model, alongside the mispricing accelerator from Figure 2.

Concluding thoughts

The centrality of interest on debt in the model (as its absence lets cycles disappear), makes the model verge on Islamic finance since one of its defining features is the prohibition of interest. To the extent that there are no hidden forms of interest, or they be at least sufficiently slight, Islamic financial systems may be less procyclical. A small but evolving literature appears to show this empirically. The model may offer theoretical support to such empirical findings.

Second, it implies the idea of developing regime-switching models with endogenous regime switching probabilities, as an econometric effigy of the structural model. In view of the strong empirical regularities, for example for the U.S. (see the paper), this may help predict recessions not only after financial market downturns happen as precursors to recessions, but well ahead of financial market stress. Frequently monitored indicators include term spreads and leverage; less prominent but regularly, cyclically behaving indicators include factor shares. These may all be used to condition the business cycle regime transition probabilities. One useful nonlinear econometric model—correlating in spirit with Minsky—while not an endogenous system and not having a regime-switching structure is Adrian et al. (2019)’s valuable Growth at Risk (GaR) framework. The model here can be seen as a theoretical grounding for GaR.

The model’s emphasis on the essence of debt squares well with the importance that policy institutions such as the IMF perceive, including regarding the role of macroprudential policies to pre-emptively curb excessive debt build-ups. Examining how macroprudential policy, besides monetary and fiscal policy, influence cyclical economic behavior in a disequilibrium model as the one considered here warrants much more exploration. Meanwhile, the strategy should be to keep all model features “maximally minimal,” adhering to a “no sophistication for the sake of it” principle.

The model codes to run the model simulations, a sneak preview of which was shown above, are available online along with the paper (link).

Note

The views expressed here are those of the author and do not necessarily represent those of the IMF, its Executive Board, or IMF Management.

References

Adrian, T., N. Boyarchenko, and Giannone, D. 2019. “Vulnerable Growth.” The American Economic Review, 109(4):1263–89.

Bernanke, B.S., M. Gertler, and Gilchrist, S. 1996. “The Financial Accelerator and the Flight to Quality.” The Review of Economics and Statistics, 78(1):1–15.

Godley, W., and Lavoie, M. 2007. Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth. Cheltenham, UK: Edward Elgar.

Gross, M. 2022. “Beautiful Cycles: A Theory and a Model Implying a Curious Role for Interest.” Economic Modelling, Vol. 106. Link.

Minsky. H.P. 1986. Stabilizing an Unstable Economy. Yale University Press.

Minsky, H.P. 1993. “The Financial Instability Hypothesis.” In Handbook of Radical Political Economy, edited by P. Arestis and M. Sawyer. Cheltenham, UK: Edward Elgar.