The new paper “A Reconsideration of Fiscal Policy in the Era of Low Interest Rates” by Jason Furman and Lawrence Summers (hereafter, FS) is most sympathetic from a policy angle. The authors drive toward their conclusion that the United States can afford the large-scale emergency programs and federal investments, even if “deficit-financed,” that the country needs, at least in the near term. On this point one cannot complain.

This note will address the underlying economics. They are a mess. To be blunt, the FS paper is built on a pastiche of obfuscations, entirely unnecessary to support the conclusion. Their effect, and one may reasonably surmise their purpose, is to make the argument without appearing to question the longstanding “mainstream” theory of interest rates. That theory, which has been the source of deficit- and debt-hysteria for several centuries, in turn underpins the newly-proposed FS debt-service-to-GDP ratio criterion for fiscal policy. It will be nothing but a source of trouble, unless disposed of.

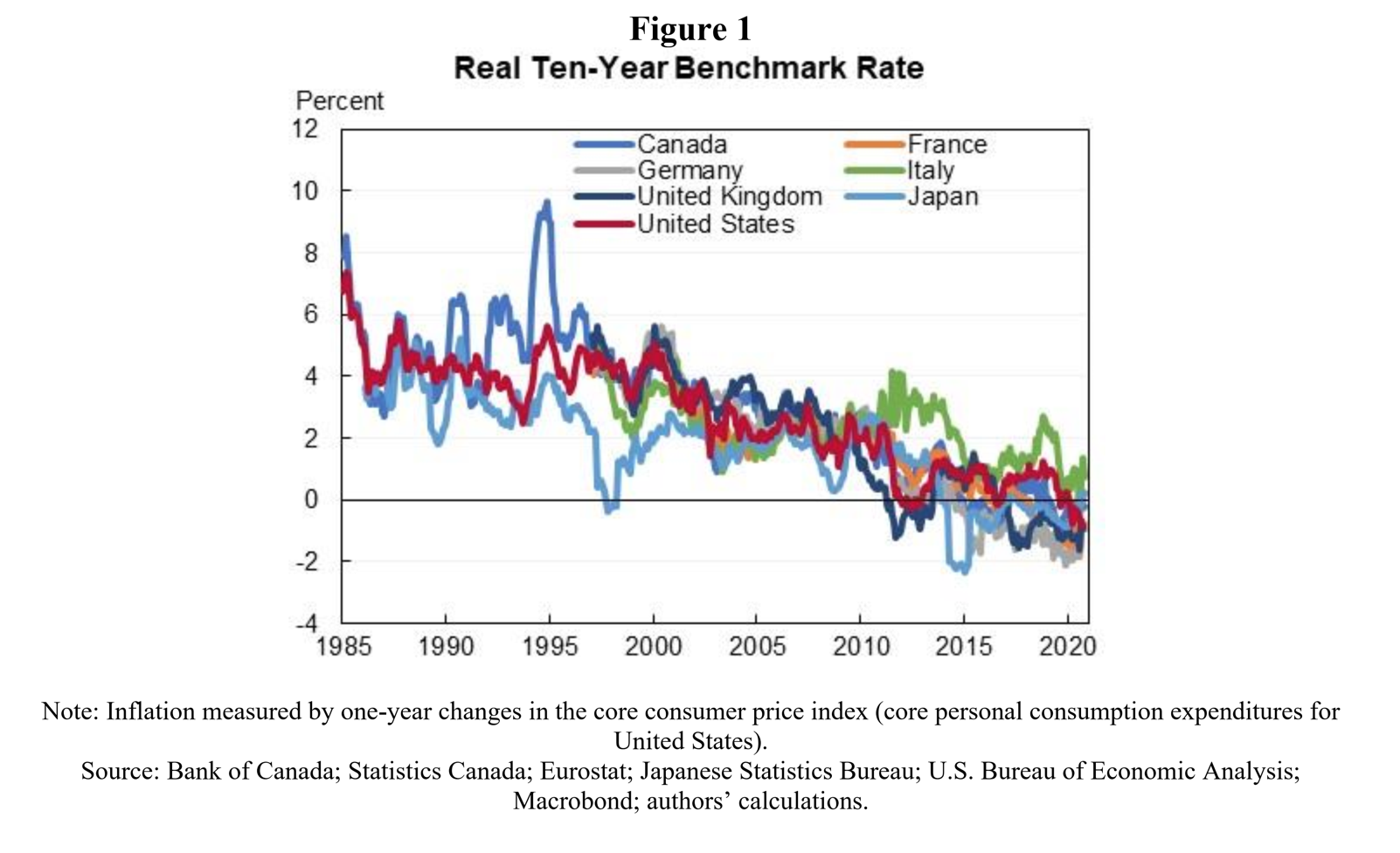

The core FS argument turns on a decline in “real” interest rates – defined as the stated (“nominal”) rates at various maturities - minus the expected rate of inflation over the same period. Since expected inflation has not risen by any known or alleged measure, this is the same thing as saying that interest rates on US Treasury bonds have fallen across all maturities, which they have (Figure 1). The question is why? To answer, FS rely on a textbook-standard theory of interest rates, known as the “loanable funds” theory, as they acknowledge on page 15.

Loanable funds is a supply-and-demand theory. It holds that there is a supply of funds, given by available savings in global (or possibly, national) capital (financial) markets, and a demand for those funds, which comes from either the public or the private sector. FS note that the demand for funds – at least recent government demands in the form of public deficits – has risen dramatically. Their theory therefore requires one of two things, perhaps in combination: a vast offsetting, autonomous increase in the supply of savings (global or national), and/or a reduction in the private demand for savings, in the form of privately-issued debt.

As to what specifically happened, FS state that the “precise reasons for the decline in real interest rates are not entirely clear” but they suggest “structural changes in the economy” that may or may not include “increasing inequality, uncertainty and the use of information technology.” When the present author was in graduate school, this was known as “hand-waving.”

There are two problems with the argument. The first is that there is no long-term trend in US private savings, nor in the import of savings from overseas – which would show up as an increasing US current account deficit relative to GDP – nor in the ratio of private debt to GDP. These numbers do fluctuate, but in ways that in no way coincide with the long-term decline in interest rates. The empirical root of the FS argument is therefore wholly imaginary.

The second problem is more theoretical. One way to put it, is to say that “loanable funds” is a theory of the spot market. It is a theory of the supply-and-demand of today’s available savings and today’s demand for funds. In this, the question of maturities is secondary. There are not separate loanable-funds markets for overnight paper, ten-year bonds, and twenty-year bonds, and so the loanable funds theory has no explanation for the difference between short and long-term interest rates – for the yield curve. But this is precisely what FS are trying to explain.

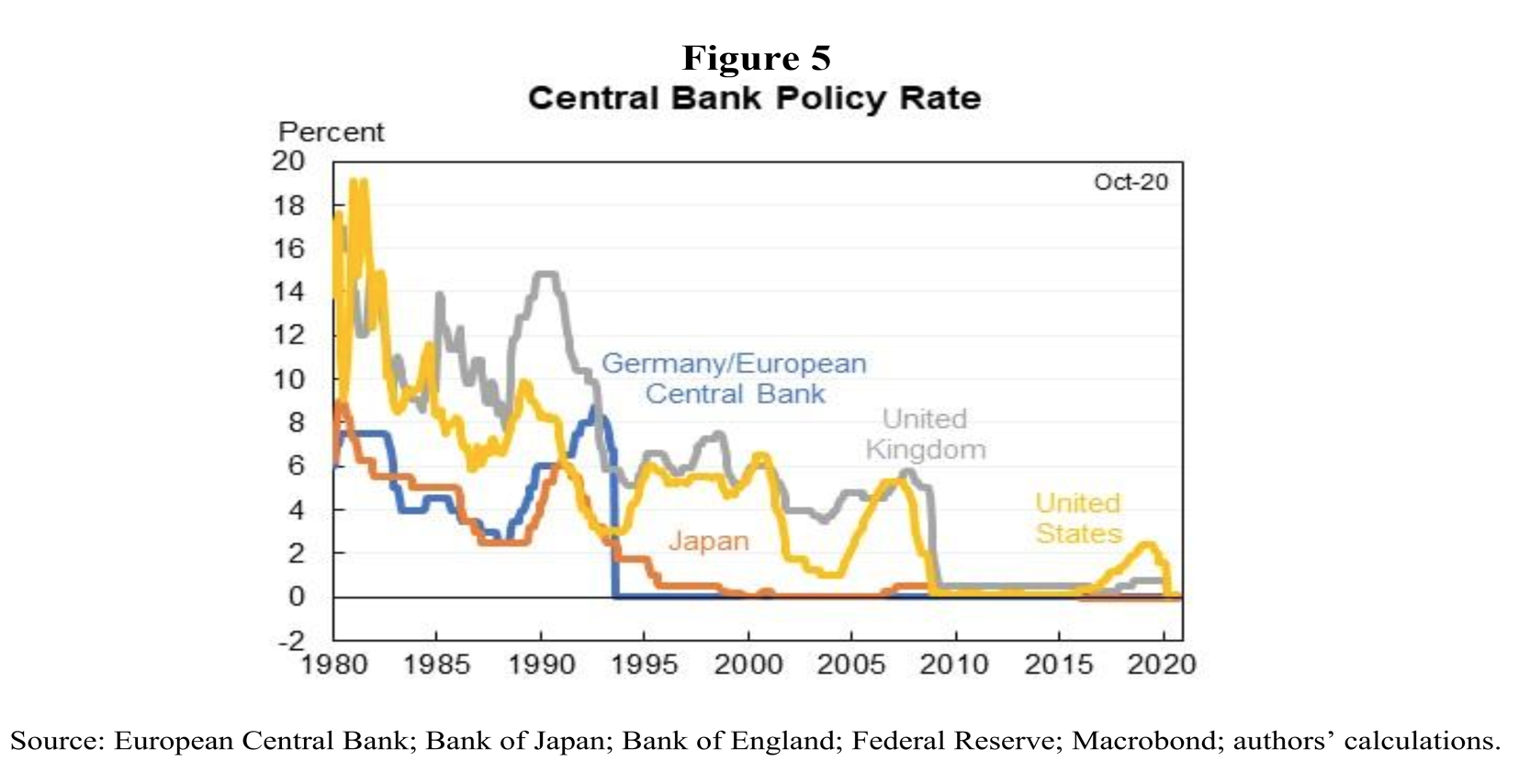

Of course we already know what determines the short-term interest rate. And we know that that determination has nothing to do with any supply of savings or demand for funds. The overnight rate on bank reserves – called the “federal funds rate” in the United States — is set by the Federal Reserve. That is what the Federal Reserve, specifically its Open Market Committee, does for a job. There is no issue about this, it is simply a statement of fact. Short-term interest rates are low because the central bank has set them at a low rate, here and abroad (Figure 5). End of story.

What then about long rates – say the rate on a ten-year Treasury bond? Here bond investors do play a role. What they do, is decide how to hold their available funds – whether in short-term paper, longer-term Treasuries, or private paper – according to their own calculations and preferences for risk and reward. And since interest rates on long-term instruments might rise at some point in the future, the price of existing bonds, paying a fixed coupon, might fall. So there is a small amount of capital risk, which could face an investor who needed to liquidate such an instrument. To compensate, investors typically need a premium over the short-term rate. Keynes called this the incentive to “not-hoard” purely liquid funds, e.g. cash or its equivalents.

How big a premium? That depends on what investors think is going to happen to interest rates – and specifically to the short rate that the Federal Reserve controls. In other words, it depends on guesses about the future of interest rate policy. Those guesses rely – because they have nothing else to rely on – on the history of short-term interest rates. If short rates were recently high, and have recently fallen, substantial opinion may expect them to rise again. And so the longer-term rate will sit well above the rate on federal funds or Treasury bills. That was the case in the 1980s and 1990s when the trend toward lower long-term interest rates got underway.

But now, for many years, short-term interest rates have been very low! FS point out that the federal funds rate has been at zero – as low as it goes – 59 percent of the time since 2007 and 38 percent of the time since 2000. Expectations, and therefore longer-term rates, have adjusted. No deeper explanation is required.

There is however one further aspect to the formation of expectations, undoubtedly obvious to investors if not to economists or public officials. Because it is based on long-term expectations, the long-term bond rate is sticky. It falls more slowly than the short rate, and it rises more slowly when short rates are pushed up. But when both sets of rates are very low – the present case – any rise in the short rate pushes that rate toward the long rate, or above it. This makes buying any form of low-risk long debt unattractive, and tends to collapse financial markets, drive up the dollar, and generally to produce havoc and recession. This is something central banks do not like. And so central bankers are stuck – they have no room to lower rates or to raise them. The expectation of a low short-term rate far into the future becomes glued to the zero bound, or very close to it.

FS therefore arrive at a correct conclusion – interest rates will remain low indefinitely – by a route that requires them to argue that the world has changed in some fundamental, relevant (“structural”) way, for which no evidence exists. The effect is to leave in place an incoherent theory of interest rates, which does not even claim to explain the phenomenon – low long-term rates – that their paper is trying to address. But a correct and viable explanation, as above, of a form long-ago explained carefully by no less than John Maynard Keynes, is readily available and wholly sufficient.

The theoretical issue is important, because it bears on FS’s proposal for a debt-service-to-GDP ratio test for future fiscal policy, and on interest rate projections on which the proposed rule depends. We now turn to these.

Under loanable funds, anything can happen to interest rates down the road. Savings (global or local) might dry up. Business investment demand might surge as employment returns to its “natural rate”. Either of these events would put upward pressure on interest rates, reversing the low-interest environment and making debt service far more “costly” than projected. And expected interest rates can rise at any time, if the designated forecaster believes any of these events are likely.

With a view that things might change, FS propose an alternative to the Debt/GDP ratio as a guideline for future fiscal policy. This is that the “projected” ratio of public debt service to GDP “not spiral upwards over the period,” which they operationalize with a proposed ceiling of 2 percent of GDP.

The ratio of debt-service-to-GDP is (obviously) just the ratio of public-debt-to-GDP times the interest rate, now taken as the average rate on the whole portfolio of federal debt. As FS note, the debt/GDP ratio “asymptotes” [sic] to a constant value whenever the rate of growth (g) of the economy is greater than the average interest rate (r). Thus to keep debt-service-to-GDP low in the long run, it is sufficient that g>r and that r be kept low – if necessary anchoring the short-term rate at zero. But as history shows and as everyone knows, controlling the short-term rate is entirely within the central bank’s power. Thus the FS criterion boils down to maintaining a positive growth rate and an easy money policy; it has nothing to do with the budget deficit, except as deficits may be needed for growth.

The FS criterion as stated may therefore prove fairly harmless. But does it make sense as a criterion of “fiscal stability”? No: it adds nothing to the discussion. The US government can comfortably pay any level of debt service, at any time, now and in the future, even if GDP falls or interest rates rise. The level of debt service in relation to GDP is just as irrelevant as the debt/GDP ratio. Adding a financial “rule” as a constraint on what now needs to be done, accomplishes nothing useful. And this one opens the door to pointless austerity later, based on some specious projection of rising interest rates.

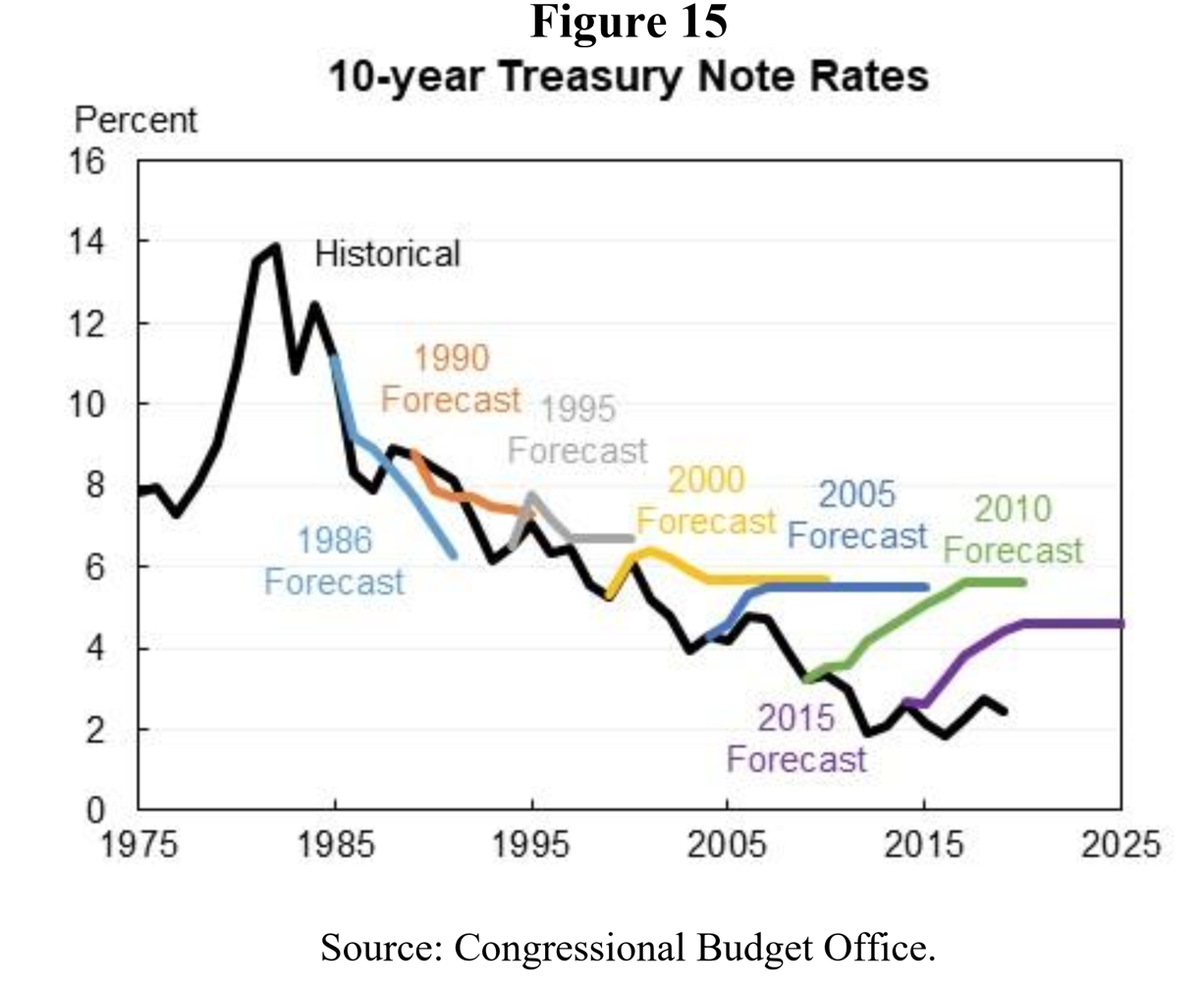

The problem is that specious official predictions of rising interest rates are entirely normal! FS include a very useful chart (Figure 15) showing the persistent – and ongoing! – forecasting failure of the Congressional Budget Office with respect to interest rates. CBO has persistently overestimated future interest rates for decades. FS note that the errors have been growing over time, but they do not point to the obvious reason, immediately visible in their chart. For at least 15 and possible 20 years, as the ten-year bond rate marched steadily downward, CBO never changed its long-term interest-rate forecast! The forecast remained stuck, for no rational reason, at a return to 6 percent. (CBO has since lowered their projections.) This ridiculous forecast was a main source of hyperventilating Washington and media predictions of debt-service explosions and debt debacles for many years.

In The Wealth of Nations, Adam Smith has a discussion of the repeal of Elizabethan laws prohibiting the taking of gold and silver “forth of the kingdom.” He explains that the arguments made against those laws, which involved substituting instead attention to the balance of trade, were “partly solid and partly sophistical.” “Such as they were, however, those arguments convinced the people to whom they were addressed… they were addressed by merchants to parliaments and to the councils of princes, to nobles, and to country gentlemen; by those who were supposed to understand trade, to those who were conscious to themselves that they knew nothing about the matter… these arguments, therefore, produced the wished-for effect… From one fruitless care, [the attention of government] was turned away to another care much more intricate, much more embarrassing, and just equally fruitless.”

Jason Furman and Lawrence Summers are in much the same position as those 17th century merchants described by Adam Smith.

For reference, relevant charts from the FS paper: