Just before the crisis, European countries were designing austerity reforms that would increase inequality and reduce internal demand. Could they return?

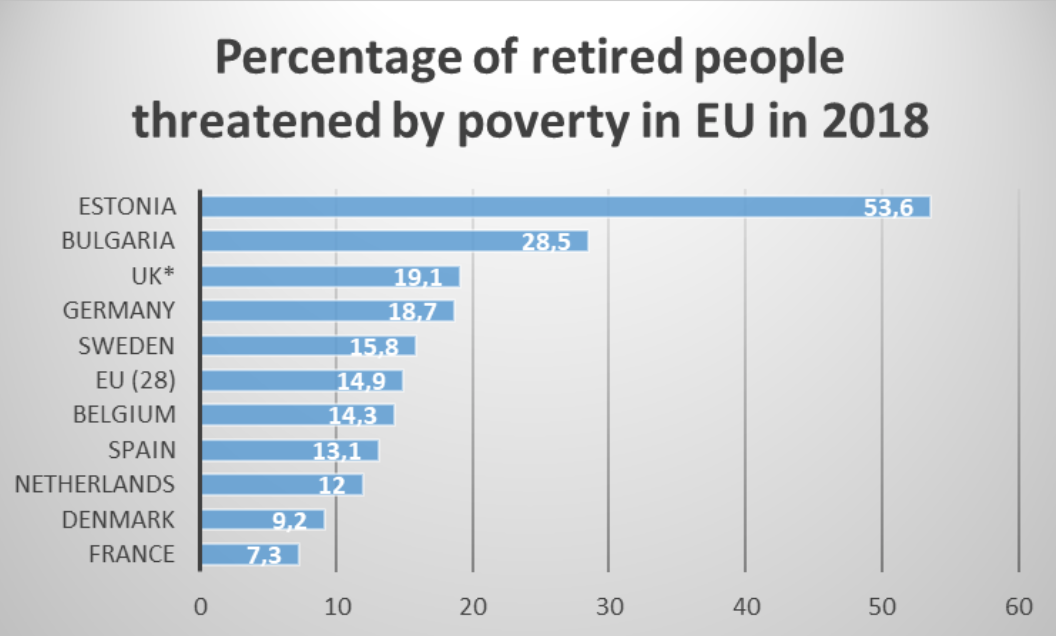

In 2018, the 14.9% of the retirees in the European Union lived in poverty. The poverty rate of pensioners in France was 7.3%, the lowest of the area (graph 1). The extraordinary impact of the French pension system on the living conditions of the elderly is such that it has survived multiple restrictive reforms, and, arguably, makes it one of the most successful programs of the national social security system ( “Sécurité sociale”).

Now the question is whether France’s national security system will survive Macron’s presidency.

Graph 1: The poverty rates of retired persons in several EU countries in 2018 *Data for 2017. Sources : Statistica, based on Eurostat

The pension reform presented by the current government rests on well-rehearsed arguments: first, the aging of the population poses budgetary problems of financial sustainability and, second, there are sectoral privileges that need to be ironed out in the name of equity considerations. In practice, however, it entails an unprecedented and radical transformation of the entire system, which can only be fully understood as one component of a more general neoliberal project, which a majority of the population fiercely opposes.

As it will be shown, Macron’s project for a universal pension system is by no means financially necessary, since the projected deficits are to a large extent obtained by policy design, for example through a reduction of the contributions paid by employers, and could be easily covered.

The social security reform will significantly reduce pensions and the replacement rates enjoyed by future pensioners, particularly civil servants, teachers, women, and low-wage workers. Moreover, it will encourage workers to participate in corporate pension funds – an option already facilitated by the “loi PACTE” of 2019, which exempts financial investment from taxation.

Ultimately, the reform, if approved, will increase inequality to a level that is likely to be politically, and not only economically, unsustainable.

1. The Current System

To be sure, the current national security system has a few holes in its racket. For example, the self-employed never wanted to join, with severe consequences on certain categories, such as farmers. It is also well-known to be rather complex. The reason, as often is the case, lies in its historical evolution from the pay-as-you-go system, created just after the Second World War. At the time, policymakers decided to maintain pre-existing schemes (“special schemes” for specific categories of workers: for example railway workers, sailors, etc.) without substantially altering them. But they also created a general program, which allowed for the possibility of adding supplementary collective pension schemes.

Contrary to popular belief, Social Security agencies are private legal bodies, distinct from the State. Indeed, initially (1945-1967), the entire system was self-managed by unions. After the ordinances of 1967, the State and the employers became involved in the governance and management of social security funds, including pension funds. The reform also implied the creation of separate financial budgets for the different programs.

On the contrary, the multiple pension schemes (“caisses de retraites”), which today add up to a total of 42 such schemes, remain financially integrated. For example, the supplementary pensions of private employees are pooled together and reciprocally responsible: the surplus in one plan, contributes to covering the deficit in another one. This integrated solidarity excludes supplementary autonomous plans, adopted by categories such as lawyers, airline pilots or liberal doctors, which are independent of social security.

The principle behind the current system is that workers need to accumulate a minimum number of annuities to qualify for a full pension. The level of the pension depends on the highest salaries obtained over 10 years before retirement.

2. The Reforms

At the aggregate level, the budget balance of a pension system can be achieved theoretically in several ways:

- by increasing social security contributions (either by raising wages, or as a percentage of the workers’ compensation);

- by reducing the pensions;

- by delaying the retirement age and increasing the number of years of pensionable service required to retire with a full pension;

- by increasing employment and wages, which increases the mass of contributions.

It will not perhaps surprise the reader to learn which of these policies governments preferred in the last thirty years. Since 1993, right-wing cabinets have carried out reforms adjusting the retirement age (from 60 to 62 years), increasing the minimum number of years of contribution (from 37.5 annuities in 1981 to 43 today) and changing the basis for the calculation of the pensions (from the 10 best years to the 25 best years in the case of private sector employees).

Since 1993, the strategy has remained the same: first, the reform hits the pensions of private sector employees, that are less unionized than are public employees; then, after some years, new legislation is proposed to align the treatment of the public employees with the others. As a broken record, governmental representatives repeat that civil servants and employees in special regimes enjoy unfair privileges, which they defend in a corporatist way.

The subsequent reforms have been presented as ways to deal with the aging of the population. However, they miss one important point: unemployment. In fact, delaying the retirement age increases the labor force and, in a low growth context such as the one we live in, this may well cause higher unemployment, in spite of the demographic changes. Even if the pension system’s budget balances out, the outlays of the unemployment insurance system within the overall Sécurité Sociale would swell. Of course, this causal link is easy to misconstrue, thanks to the separation of the budgets of each of the social security programs. In addition, the outcome offers an argument in favor of cutting unemployment benefits. Moreover, by increasing the unemployment of elderly workers, such strategies have slowly decreased the replacement rate[1] and the level of pensions since these elderly workers would be receiving unemployment benefits that would trigger a cut in their pension transfers. Lower pensions imply also a lower aggregate demand.

But is there really a financial emergency? Contrary to government’s rhetoric, there is not. Indeed, the Conseil d’Orientation des Retraites, a committee that regularly issues reports on the pension system, expects the pension funds to run a deficit between 8 and 17 billions for 2025. However, this deficit is in fact artificial, as it has been shown by many economists:[2]

- At the consolidated level, Sécurité Sociale has surplus;

- the different pension schemes hold important reserves of more than 150 billion euros;

- the debt of Sécurité Sociale will be reimbursed in 2024 through the Caisse d’Amortissement de la Dette Sociale (CADES) which collects part of the Cotisation Sociale Généralisée (CSG) and Contribution au Remboursement de la Dette Sociale (CRDS). Part of those tax receipts could be reallocated to the funding for the pension system. As the director of CADES declared to Reuters, that “the CSG does not disappear but will be reallocated. […] In total, a sum of 24 billion euros in value 2024 will be available, of which 9 billion under the CRDS alone, adding that no government has historically found itself having to arbitrate the allocation of such a windfall;”[3]

- The deficit of “special regimes” are a very small part of the total pension outlays;

- The deficit planned for pensions system by the Conseil d’Orientation des Retraites is in fact the consequences of the previous and projected decisions of this government to decrease the resources by reducing public employment and by giving firms large exemptions of social contributions in an effort to reduce labor costs, without little effect on unemployment.[4]

- A gradual increase of the rate of social security contributions by 0.2-0.3% annually would be enough to eliminate the so-called deficit.[5]

3. The Current Reform Project in the Context of Macron’s Broader Economic Plans

In order to understand the widespread lack of support for the reform, which was foreseen in Macron’s program for the presidential elections and was brought forward by a special High Commissioner, Jean-Paul Delevoye, one needs to consider also the broader package of austerity and neoliberal measures that the government is undertaking (allegedly) to please the European Commission. People are reacting to the fact that, on the one hand, this government reformed the wealth tax to apply only to real estate and exempt financial assets, thus favoring the richest who invest on the stock market. On the other hand, it reduced employers’ social contributions and employment protection by reforming France’s labor law; and it cut social benefits and implemented budgetary austerity in the public services.

Moreover, the current pension reform project not only does not move away from the well-known script of the past increases of the retirement age, but it pushes the line a little farther. Macron’s plan seeks to transform the current system into one unique and universal contributory, defined contribution (or, more exactly, defined yield) scheme, called the point system (“système par points”) based on a new definition of “pivotal age,” whereby, unlike in a defined benefit system, the retired employee’s pension benefits would be tied to the vagaries of the conjuncture. In addition, the system is supposed to adjust automatically the value of the points and the pensions, possibly downwards, to macroeconomic constraints. In practice, it means that pension rights are not really guaranteed (it is a defined contribution system), while the cumulative effects of the points system and the pivotal age will be a reduction in age replacement rates for most pensioners,[6] even if the value of the point is indexed on prices or wages.[7]

Allegedly, such new model would favor professional mobility and would be better suited to a flexible labor market, and a world where the notion of career is increasingly blurred. The bill is also presented as a means of reducing pension inequality between men and women, but the argument is not convincing, not least because the new law tweaked various “bonuses” such as those for maternity.

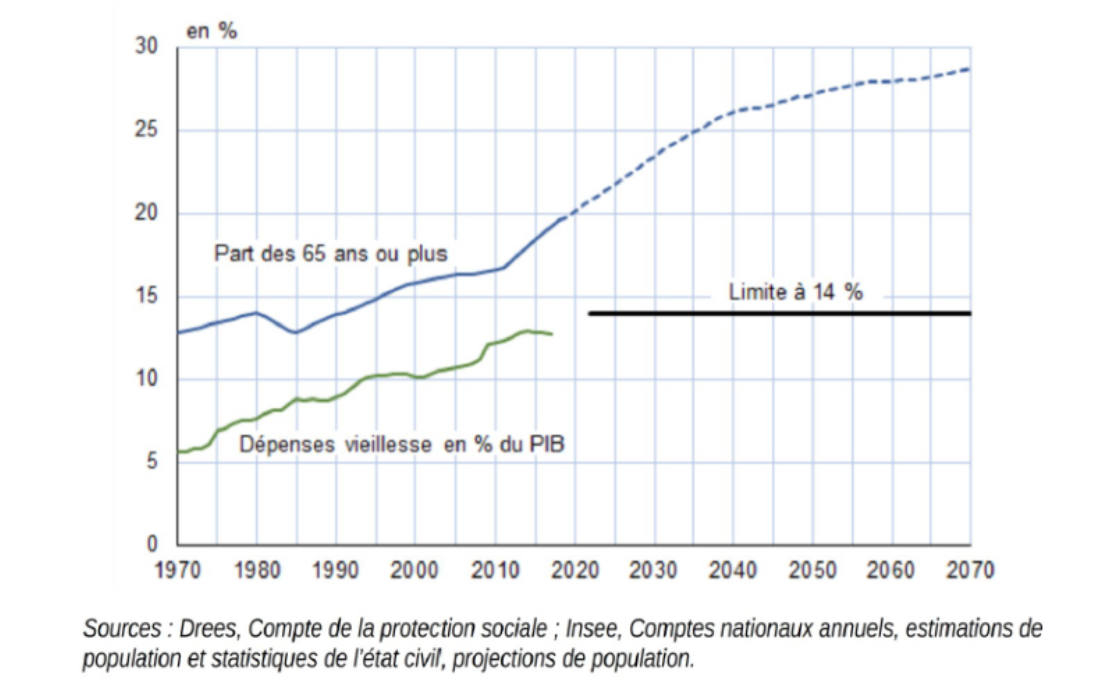

In order to meet the EU budgetary constraints and to reduce public expenditures, the government concocted several mechanisms to ensure reduction of individual pensions. The first article includes an objective of equilibrium of budget, a sort of golden rule of pension finance[8] but no reference to any rate of replacement of 75% or a decent level of pension compared to active workers. One crucial proposal is to cap the total pension outlays to 14% of GDP (i.e. roughly the current level). The cap would occur in the face of a projected increase in the proportion of elderly people in the total population (graph 2). But worse than that, the government endorses and amplifies certain past reforms that will lead to reductions in the share of pensions in GDP and that should instead have been repealed in order to maintain replacement rate. Indeed, the precedent reforms has already reduced pensions and will still continue to do it, but the final simulation of the effects of this new reform plans a decrease to 12.9% of the share of pensions in GDP from now to 2050.[9] As many heterodox economists, who mobilized against the reform,[10] including some from the national institute of statistics (INSEE),[11] have underlined, this means that the government is ruling out any future increase in the contribution rate. This will ensure that the relative purchasing power of pensioners will decrease in relation to that of working people and the retirees with an individual pension plan. Therefore, in the future, the share of poor elderly people could strongly increase.

Graph 2: Share of the population over 65 years old (blue) and share of pensions in GDP (green and black) Source : Comité de mobilisation de la DG INSEE

Moreover, the pension benefits would be computed based on all the professional years, and not the 25 best ones (or the last 6 months for civil servants), which means that every incident, periods of precarious employment at the beginning of one’s career, etc. will strongly impact future pension benefits, especially for women or people with low qualifications. The new system would introduce a “pivotal full equilibrium age” (in fact the new normal age of retirement) age of 64, different from the statutory minimum retirement age of 62, which would increase gradually and automatically by one month every year, or even more depending on the conjuncture. A pension suffers a 5% reduction for every year of pre-retirement relative to the pivotal age, and a symmetric incentive applied for those who continue to work. Thus, an employee leaving at 62 would see his pension reduced by 10% compared to a full pension.[12] Inevitably, this affects particularly people who entered the labor force at an early age, who often worked in physically demanding and poorly paid jobs. But the age of 64 will only be applied to the generation that will retire in 2022 and born before 1975 and that will not contribute in the new ‘universal’ scheme (their pensions will be paid through the current system). For the generations that will really have pensions paid by the new ‘universal’ scheme, i.e people that will retire after 2037, their normal age of retirement will be 65, 66 or more depending when they are born.

However, in its communications, Delevoye declared that the shift towards the new system will have a negligible effect on the level of pensions. A report issued by the Commission he chairs illustrates the claim through ‘pedagogic’ examples,[13] which many economists and most unions have shown being a blatant misrepresentation of the facts, where the benefits of the current system are artificially downgraded to be equivalent to the level of pensions computed in the new system.[14]

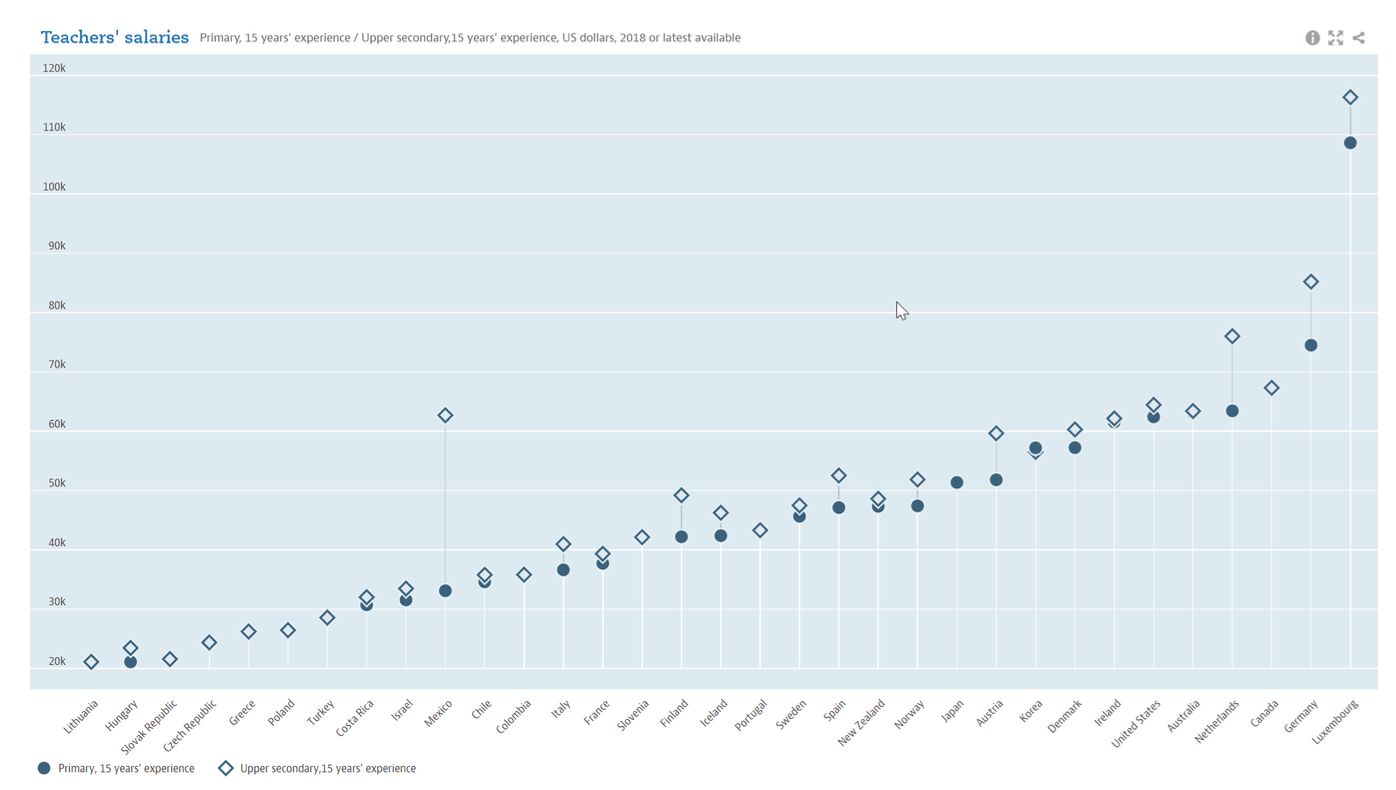

The main losers of the new universal system will be civil servants (especially teachers), workers with special regimes (like railway workers or sailors), workers with physically demanding jobs who started at an early age, or those with low wages, and self-employed workers who are in self-employed regimes (such as lawyers). In the case of teachers and professors, the current simulations show that their pensions would fall on average by 30% (sometimes more). This case is very tricky, because the implicit contract between civil servants and the government was to accept quite low wages compared to their qualification (frozen in nominal terms for years, i.e a fall in real terms) in exchange for better retirement conditions (the average compensation of French teachers is under the average of their OECD comparator groups, graph 3). Thus, even including bonuses in the calculation of pensions, which are low in the national education system, salaries would have to be increased by more than 50% to compensate for the future drop in pensions. This is very unlikely, since Macron himself said he would not do it because it would cost 10 billion euros annually to compensate for the fall in pensions (and in conflict with the objective of reduction of public expenditures of this government). In contrast, the government will increase the budget by less than 500 million euros in bonuses (not wages) in exchange for new tasks for teachers.

Moreover, the threshold above which salaries are not subject to contributions and do not count for calculating the pension would decrease to 120,000 euros (annually). However, already retired managers with high pensions would still have to be paid, so, ironically, it would create a deficit of contributions of 3 or 4 billions euros annually[15] although one (bad) argument for the reform is to reduce the deficit.

Ironically, during a transition period between 2022 and 2037, there would be more than 42 schemes: the (not so) “universal one” applied to workers entering the labor market in 2022, the 42 previous ones for the retired workers born before 1975, and a mixture of the two for individuals already active and born after 1975. This transition period might raise some funding problems which would not exist without the reform. Indeed, only the workers beginning their career in 2022 would contribute to the new scheme, while those who are currently retired would still have to be paid according to the current schemes.

Graph 3: Teachers’ salaries in OECD Source: OECD

By decreasing the level of pensions, the reform will incentivize people, especially managers, to complement their social security pension with funded schemes, i.e investing their savings in the stock market through new vehicles… Indeed, Black Rock, Amundi Capital or Axa appear very interested and eager to collect the workers’ savings and develop their pension funds industry in France. Indeed, Axa made also an advertising on his website (now removed due to the polemic),[16] where it openly stated that the pensions will decrease, so people should invest in saving plans. Blackrock made a statement on the fiscal advantages introduced by loi PACTE. The government openly favors this solution; in fact, it passed a law last year (loi PACTE) to reduce the tax rates on saving plans called Plan d’Epargne Retraite (PER). The current project of law reforming pension confirms the role of those PER. Considering the fact that high paid managers would have less interesting pensions through the new “universal” regime, they would be strongly incentivize to invest in those saving plans. In fact, it is the introduction of a second pillar, voluntary, in the pension system[17]. Last but not least, High Commissioner Jean-Paul Delevoye was obliged to resign due to a lack of disclosure of conflicts of interests with insurances companies, and Jean-François Cirelli, current PDG of Blackrock France, by the hazard of agenda, has been made “Commandeur de la Légion d’Honneur” in January 2020. Therefore, it is hard to pretend, like the government does, that this reform will reduce inequalities, secure the current pension system, and create a universal regime although it introduces a second voluntary pillar.

4. Political struggle in neoliberal post-democracy

The mobilization has involved many workers and all the main unions, especially CGT, FO, FSU, UNSA who are organizing regular demonstrations. Even CFDT, the “reformist” union, is now openly opposing the government, even if it generally supports the introduction of a universal regime. In fact, its intention is to negotiate the abolition of the pivotal age, obtain special treatment for workers in physically demanding jobs and guarantee 50% of votes for unions in the governance of the future pension system. The strategy for the government is of course, as usual, to split the movement by denouncing the privileged, but also by guaranteeing the special regimes of the policemen and army (to maintain social order), flight crew, lawyers and to apply the reform only to the generations born after 1975, i.e the young ones.

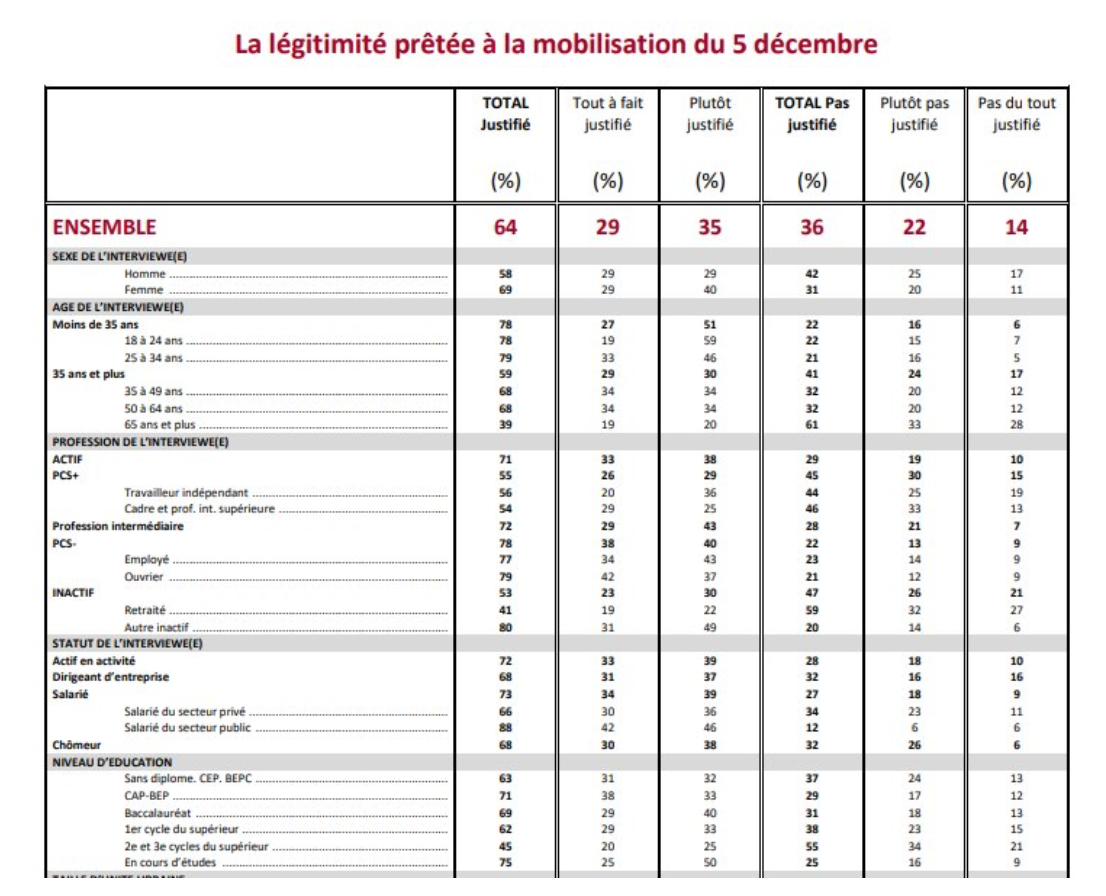

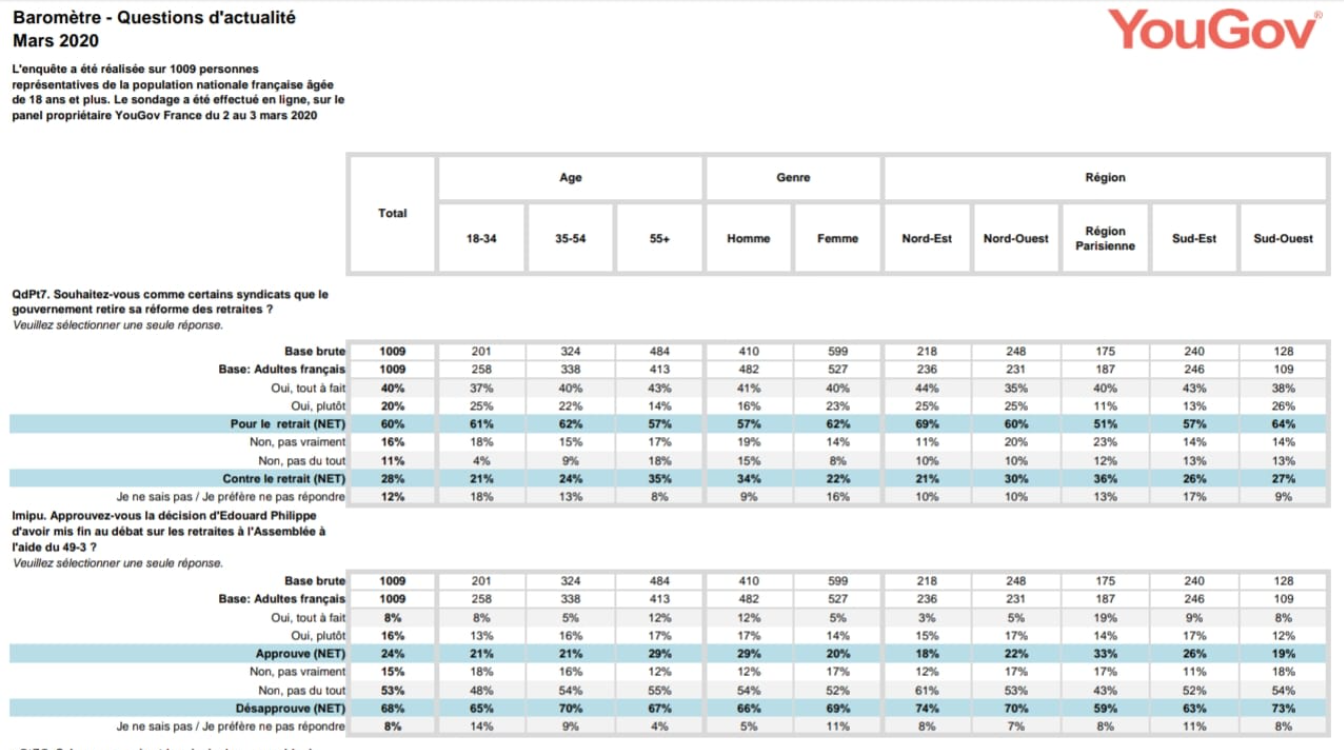

In its declaration, the Prime Minister Edouard Philippe claimed that the government does not want to give in on the pivotal age and on the physically demanding jobs, but the CFDT, which is the main federation of unions in the private sector, will not sign the reform without a negotiation on those subjects. However, the majority of French citizens are against this reform and support the demonstrations, despite the inconveniences that strikes cause, especially in public transportation. The MEDEF, the association representing large companies, does not support the reform, because it expects that employees could demand higher wages. The coalition does not seem to show signs of fatigue: as testified by two polls, one performed at the beginning of the strikes in December 2019 and one in March 2020, the only people in favor of the reform remain those over 65 years of age, in other words, people who will not be affected by it and who voted for Macron (see table 1 and 2). Indeed, at this point, it is more than just pensions: the opposition to this reform regroups and synthesizes the general discontent against Macron’s policies, leading some trade unionists and activists to overwhelm the demands of the trade union confederations: some federations of transports and civil servants affiliated to CFDT or UNSA (the “reformist” unions confederations) are more combative. Remember that, for a year now, the yellow vests have been demonstrating and calling for the resignation of the President. The government, by favoring the richest at the beginning of its term of office and by having strongly repressed the Yellow Vests movement, has sharply reduced its legitimacy among a large part of the population and seems to be positioning itself more and more to the right, as the new party of order. However, the political opposition being weak in parliament, the social movement were unable to find political mediation to express itself. It did not help that the government tried repeatedly to bypass parliamentary discussion. First, it chose an “accelerated procedure” at the Assemblée Nationale, which reduced the time of the examination of the law. When the oppositions tabled a very high number of amendments to delay the government, they discovered that the final text differed by the initial Delevoye report, presenting an even worse plan that would decrease the share of pensions in GDP further, with a very unclear mode of indexation and no clear rate of return. At that point, the government responded by using the infamous and very undemocratic article 49 alinea 3 of the V° French Constitution. This article stops all the discussions on the text and amendments, leaving as the only option for oppositions the tabling of a motion of censure against the government, which had no chance of being voted thanks to the large majority of Macronist deputies. It is really a typical case of a post-democratic capitalism in a finance-dominated accumulation,[18] or a way to overcome “the costs” of democracy. The height of cynicism is that the government decided to use the article 49-3 during a Council of Ministers whose main purpose was the preparation for the coronavirus epidemic. In hindsight, considering the current sanitary crisis and the lack of preparation of the authorities, the government would certainly have made better use of everyone’s time to prepare for this health crisis instead of stubbornly carrying out this reform at all costs. Needing a strong support of the population to manage the health crisis and in a context of strong recession, the President, on march 16th, finally decided to postpone the pension reform until an uncertain date. Finally, the coronavirus has been more effective than the large demonstrations and strikes to block the reform and to change the direction of the economic policy. After the health crisis, we will see if this government will face a strong backlash.

Table 1 : Poll in December 2019: “Do you think the December 5th protest is legitimate?” Source : Odoxa-Dentsu Consulting

Table 2 : Polls in march 2020 : « Do you want like some unions that the government withdraws his reform ? » & « Do you approve the decision of Edouard Philippe to end the debate on pensions at Assemblée Nationale by using article 49-3 ? »

[1] The replacement rate is the ratio between the best wages and the first pension. In the current system, a full pension is equal to 75% of the best wages, i.e a replacement rate.

[2] https://www.capital.fr/votre-r… 28/12/2019

[3] Reuters, 11/12/2018, https://fr.reuters.com/article/frEuroRpt/idFRL8N1YG5NY

[4] https://fr.calameo.com/read/002473731006f451c557f

[5] https://blogs.alternatives-economiques.fr/zemmour/2019/12/03/qui-paiera-la-retraite-du-top-management-28-le-compte-n-y-est-pas, 28/12/2019

[6] In the Delevoye’s report, the yield was set at 5.5% (the acquisition value of the point is EUR 10 and the non-discounted refund value is EUR 0.55 per point per year), but in the final text, this yield is not clearly defined.

[7] The yield being fixed at 5,5%, even if the value of point is indexed on wages, it does not mean that the pension won’t be reduced, because there’s a rate of conversion of the non-discounted refund value. For more details : https://blogs.alternatives-eco… 28/12/2019

[8] https://blogs.alternatives-eco…

[9] https://www.alternatives-econo…

[10] https://blogs.alternatives-eco…

[11] Comité de mobilisation de la DG INSEE, n°spécial décembre 2019.

[12] Comité de mobilisation de la DG INSEE, n°spécial décembre 2019.

[13] Delevoye Jean-Paul, Pour un système de retraite universel, Préconisations de Jean-Paul Delevoye, Haut-Commissaire à la réforme des retraites https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=2ahUKEwijtYHB99fmAhWpAGMBHW4hBaMQFjAAegQIARAH&url=https%3A%2F%2Freforme-retraite.gouv.fr%2FIMG%2Fpdf%2Fretraite_01-09_leger.pdf&usg=AOvVaw0RtBuKdwZYI8Y57gc7M1X_, 28/12/19

[14] https://blogs.mediapart.fr/les-economistes-atterres/blog/261219/la-carriere-de-christelle-vers-une-baisse-de-36-de-la-retraite-des-enseignants?utm_source=facebook&utm_medium=social&utm_campaign=Sharing&xtor=CS3-66&fbclid=IwAR3psqlPZap2t3cKDz5OCfOIxAfouXniMcb0yMWIzgshUEbErHRHDNB1qGo 28/12/19

[15] https://blogs.alternatives-economiques.fr/zemmour/2019/12/03/qui-paiera-la-retraite-du-top-management-28-le-compte-n-y-est-pas

[16] https://blogs.mediapart.fr/645152/blog/180120/axa-prevoit-la-baisse-programmee-des-futures-pensions-dans-une-affiche-publicitaire?fbclid=IwAR2CPKMCafdPVYF2U6wwo-lltP7To4sdLweDy2_-uGOSb7D4uXJqEIwEo-s

[17] « La loi PACTE : le bon plan retraite », Viewpoint of Blackrock, june 2019.

[18] https://bobjessop.wordpress.com/2014/04/01/finance-dominated-accumulation-and-post-democratic-capitalism/