Perry, Dave Grad and I have just wrapped up a paper on the subject. Now I’m using the liquidity program transaction data, released in December 2010, to flesh out that work. I will post interim results here.

TSLF is a good place to start. To understand what the Term Securities Lending Facility did and what problem it was trying to solve, we have to understand what broke in the repo market, a key ingredient in the modern financial system. Repo is collateralized lending, allowing a borrower to obtain an amount of money against securities of slightly greater value. It is a very cheap and liquid source of funds, as long as you’ve got collateral that someone will accept.

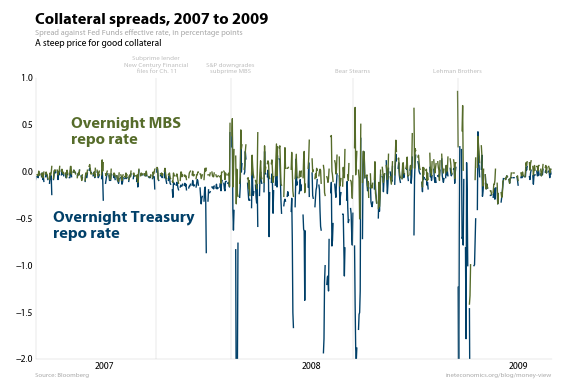

This graph shows how the crisis began to show up in the repo markets:

Before the crisis, overnight financing cost you the same amount whether it was against Treasury or agency-backed MBS collateral. Then, in mid-2007, the rate for Treasury repo falls relative to the MBS repo rate—the blue line falls relative to the green line.

Following a big downgrade of subprime MBS securities by Standard and Poors, the rating agency, the situation worsened. Big spikes down for Treasury repo, big spikes up for MBS repo. Translation: the market was demanding good collateral.

Even more, since lenders can take collateral that they receive and turn it around to obtain financing themselves, lenders were working hard to get the best collateral, which is why those downward spikes were so deep. The premium was on the collateral, and if you had it, you could borrow for cheap.

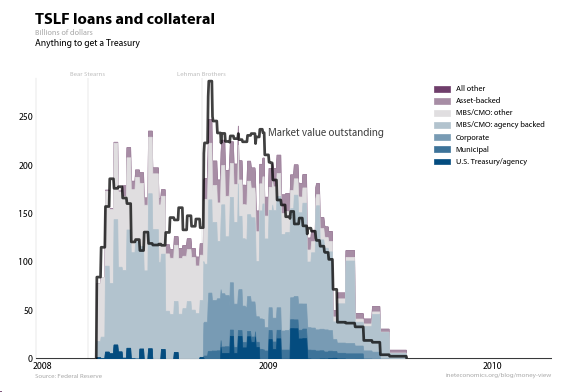

Trouble was, nobody had good collateral. So the Fed created TSLF: borrowers could swap their low-quality securities for Treasuries, which they could turn around and put out on repo. The Fed was keeping the repo system going.

This graph shows the market value of Treasuries outstanding (black line) and the types of collateral accepted.

More on the intricacies of TSLF next time. But if you look back up to the first graph, you can see that it worked: repo spreads narrowed between Bear’s acquisition and Lehman’s bankruptcy. TSLF was expanded when spreads widened after Lehman, and the spreads came down again quickly. Here’s a more thorough investigation of the effects of TSLF.